Cricket Wireless 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

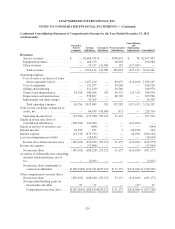

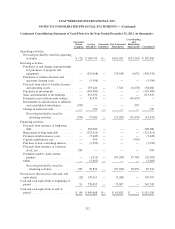

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

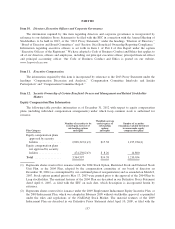

Condensed Consolidating Statement of Cash Flows for the Year Ended December 31, 2011 (in thousands):

Guarantor

Parent

Company

Issuing

Subsidiary

Guarantor

Subsidiary

Non-Guarantor

Subsidiaries

Consolidating

and

Eliminating

Adjustments Consolidated

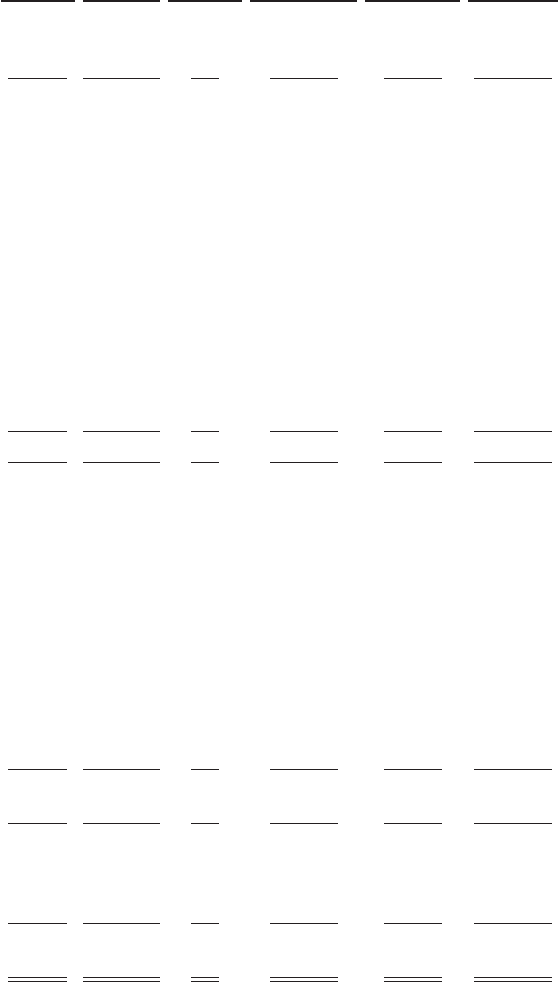

Operating activities:

Net cash provided by operating

activities ......................... $ 6 $358,123 $— $ 35,126 $(5,746) $ 387,509

Investing activities:

Acquisition of a business .............. — (850) — — — (850)

Purchases of and change in prepayments

for purchases of property and

equipment ....................... — (427,934) — (23,666) — (451,600)

Purchases of wireless licenses and

spectrum clearing costs ............. — (4,880) — — — (4,880)

Proceeds from sales of wireless licenses

and operating assets ................ — 4,558 — 512 — 5,070

Purchases of investments .............. — (826,233) — — — (826,233)

Sales and maturities of investments ..... — 487,860 — — — 487,860

Investments in and advances to affiliates

and consolidated subsidiaries ........ (1,346) — — — 1,346 —

Dividend received from equity investee . . — 11,606 — — — 11,606

Change in restricted cash .............. — (248) — (700) — (948)

Net cash used in investing activities . . . (1,346) (756,121) — (23,854) 1,346 (779,975)

Financing activities:

Proceeds from issuance of long-term

debt ............................ — 396,772 — — — 396,772

Repayment of long-term debt .......... — (18,589) — (5,000) — (23,589)

Payment of debt issuance costs ......... — (7,269) — — — (7,269)

Capital contributions, net .............. — 1,346 — — (1,346) —

Proceeds from the issuance of common

stock, net ........................ 1,346 — — — — 1,346

Proceeds from sale lease-back

financing ........................ — 25,815 — — — 25,815

Payments made to joint venture

partners ......................... — (1,364) — (7,490) 5,746 (3,108)

Other ............................. — (3,048) — — — (3,048)

Net cash provided by (used in)

financing activities ............... 1,346 393,663 — (12,490) 4,400 386,919

Net increase (decrease) in cash and cash

equivalents ......................... 6 (4,335) — (1,218) — (5,547)

Cash and cash equivalents at beginning of

period ............................. 85 274,390 — 76,315 — 350,790

Cash and cash equivalents at end of

period ............................. $ 91 $270,055 $— $ 75,097 $ — $ 345,243

133