Cricket Wireless 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

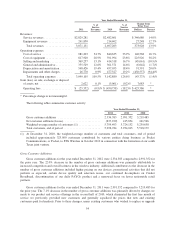

owed and remitted to government agencies. Regulatory fees and telecommunications taxes separately billed and

collected from our customers are recorded in service revenues. Amounts owed to government agencies are

recorded in cost of service. During the years ended December 31, 2012, 2011 and 2010 the total amount of

regulatory fees and telecommunications taxes separately billed and collected from customers and recorded in

service revenues was $9.4 million, $32.6 million and $108.4 million, respectively. Sales, use and excise taxes for

all service plans are reported on a net basis.

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements defines fair value for accounting purposes,

establishes a framework for measuring fair value and provides disclosure requirements regarding fair value

measurements. The guidance defines fair value as an exit price, which is the price that would be received upon

sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the

measurement date. The degree of judgment utilized in measuring the fair value of assets and liabilities generally

correlates to the level of pricing observability. Assets and liabilities with readily available, actively quoted prices

or for which fair value can be measured from actively quoted prices in active markets generally have more

pricing observability and require less judgment in measuring fair value. Conversely, assets and liabilities that are

rarely traded or not quoted have less pricing observability and are generally measured at fair value using

valuation models that require more judgment. These valuation techniques involve some level of management

estimation and judgment, the degree of which is dependent on the price transparency of the asset, liability or

market and the nature of the asset or liability. We have categorized our assets and liabilities measured at fair

value into a three-level hierarchy in accordance with the guidance for fair value measurements.

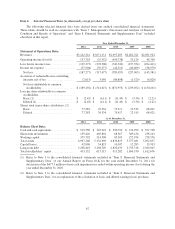

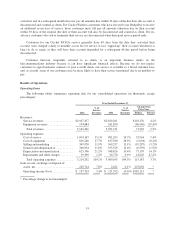

Depreciation and Amortization

Depreciation of property and equipment is applied using the straight-line method over the estimated useful

lives of our assets once the assets are placed in service. The following table summarizes the depreciable lives (in

years):

Depreciable

Life

Network equipment:

Switches .............................................................. 5-10

Switch power equipment .................................................. 15

Cell site equipment and site improvements ................................... 5-7

Towers ................................................................ 15

Antennae .............................................................. 5

Computer hardware and software ............................................. 3-5

Furniture, fixtures, retail and office equipment .................................. 3-7

Impairment of Long-Lived Assets

We assess potential impairments to our long-lived assets, including property and equipment and certain

intangible assets, when there is evidence that events or changes in circumstances indicate that their respective

carrying values may not be recoverable. An impairment loss may be required to be recognized when the

undiscounted cash flows expected to be generated by a long-lived asset (or group of such assets) is less than its

carrying value. Any required impairment loss would be measured as the amount by which the asset’s carrying

value exceeds its fair value and would be recorded as a reduction in the carrying value of the related asset and

charged to results of operations.

During the fourth quarter of 2012, in connection with our plans to reduce our previously planned network

expansion activities and overall capital expenditures, certain projects relating to network design, site acquisition

and other internal corporate initiatives were canceled. Therefore, we determined that certain capitalized amounts

47