Cricket Wireless 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

were unable to obtain or maintain cost-effective roaming or wholesale services for its customers in

geographically desirable service areas, the Company’s competitive position, business, financial condition and

results of operations could be materially adversely affected.

Operating Leases

Rent expense is recognized on a straight-line basis over the initial lease term and those renewal periods that

are reasonably assured as determined at lease inception. The difference between rent expense and rent paid is

recorded as deferred rent and is included in other current or long-term liabilities in the consolidated balance

sheets. Rent expense totaled $256.3 million, $260.6 million and $252.5 million for the years ended December 31,

2012, 2011 and 2010, respectively.

Asset Retirement Obligations

The Company recognizes an asset retirement obligation and an associated asset retirement cost when it has a

legal obligation in connection with the retirement of tangible long-lived assets. These obligations arise from

certain of the Company’s leases and relate primarily to the cost of removing its equipment from such lease sites

and restoring the sites to their original condition. When the liability is initially recorded, the Company capitalizes

the cost of the asset retirement obligation by increasing the carrying amount of the related long-lived asset. The

liability is initially recorded at its present value and is accreted to its then present value each period, and the

capitalized cost is depreciated over the useful life of the related asset. Accretion expense is recorded in cost of

service in the consolidated statements of comprehensive income. Upon settlement of the obligation, any

difference between the cost to retire the asset and the liability recorded is recognized in operating expenses in the

consolidated statements of comprehensive income.

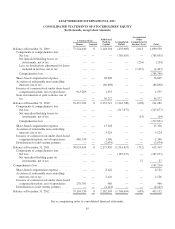

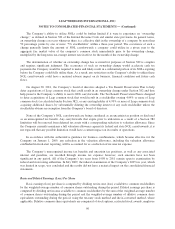

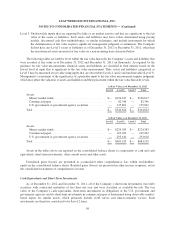

The following table summarizes the Company’s asset retirement obligations as of and for the years ended

December 31, 2012 and 2011 (in thousands):

Year Ended

December 31,

2012 2011

Asset retirement obligations, beginning of year .......................... $32,919 $31,663

Liabilities incurred .............................................. 815 193

Liabilities assumed by STX Wireless in connection with the formation of the

joint venture .................................................. — (828)

Accretion expense ............................................... 3,208 3,061

Decommissioned sites ............................................ (712) (1,170)

Asset retirement obligations, end of year ............................... $36,230 $32,919

Debt Issuance Costs

Debt issuance costs are amortized and recognized as interest expense using the effective interest method

over the expected term of the related debt. Unamortized debt issuance costs related to extinguished debt are

expensed at the time the debt is extinguished and recorded in loss on extinguishment of debt in the consolidated

statements of comprehensive income. Unamortized debt issuance costs are recorded in other assets or as a

reduction of the respective debt balance, as applicable, in the consolidated balance sheets.

94