Cricket Wireless 2012 Annual Report Download - page 94

Download and view the complete annual report

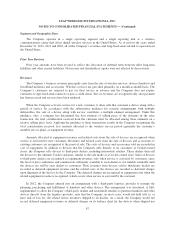

Please find page 94 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The table above does not include the following contractual obligations relating to STX Wireless:

(1) Cricket’s obligation to pay to Pocket, if Pocket exercises its right to sell its membership interest in STX

Wireless to Cricket, an amount equal to 24.25% of the product of Leap’s enterprise value-to-revenue multiple for

the four most recently completed fiscal quarters multiplied by the total revenues of STX Wireless and its

subsidiaries over that same period, which amount is estimated to be approximately $64.5 million as of

December 31, 2012; and (2) STX Wireless’ obligation to make quarterly limited-recourse loans to Pocket out of

excess cash in an aggregate principal amount not to exceed $30.0 million.

Recent Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update

No. 2012-02, “Testing Indefinite-Lived Intangible Assets for Impairment” or ASU 2012-02. ASU 2012-02

simplifies the requirements for testing for indefinite-lived intangible assets other than goodwill and permits an

entity to first assess qualitative factors to determine whether it is necessary to perform a quantitative fair value

test. This new guidance is effective for us beginning in the first quarter of 2013 and will be applied prospectively.

We anticipate that the adoption of this standard will not have a material impact on us or our consolidated

financial statements.

Off-Balance Sheet Arrangements

We do not have and have not had any material off-balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Risk

Our senior secured, senior and convertible senior notes all bear interest at fixed rates and, accordingly, our

exposure to market risk for changes in interest rates relates primarily to borrowings under our Credit Agreement.

As of December 31, 2012, we had $400 million in principal amount of outstanding borrowings under our Credit

Agreement. Borrowings under our Credit Agreement bear interest at LIBOR plus 3.50% (subject to a LIBOR

floor of 1.25% per annum) or at the bank base rate plus 2.50% (subject to a base rate floor of 2.25% per annum),

as selected by Cricket. Our primary interest rate under the Credit Agreement is LIBOR plus 3.50%. At

December 31, 2012, the weighted average effective interest rate on outstanding borrowings under the Credit

Agreement was 4.80%. Assuming the outstanding balance under our Credit Agreement remained constant over a

year, a 100 basis point increase in the interest rate would decrease pre-tax income, or increase pre-tax loss, by

approximately $4.0 million.

As of December 31, 2011, all of our senior indebtedness bore interest at fixed rates, and accordingly our

senior indebtedness did not expose us to market risk for changes in interest rates as of such date. The change

during the year ended December 31, 2012 resulted from Cricket’s entry into the Credit Agreement in October

2012 with respect to our $400 million senior secured term loan facility. which bears interest at a variable rate, the

net proceeds of which were used to redeem all of our 10.0% unsecured senior notes due 2015 and for other

general corporate purposes.

Our investment portfolio consists of highly liquid, fixed-income investments with contractual maturities of

less than one year. The fair value of such a portfolio is less sensitive to market fluctuations than a portfolio of

longer term securities. Accordingly, we believe that a significant change in interest rates would not have a

material effect on our investment portfolio.

80