Cricket Wireless 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements defines fair value for accounting purposes,

establishes a framework for measuring fair value and provides disclosure requirements regarding fair value

measurements. The guidance defines fair value as an exit price, which is the price that would be received upon

the sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the

measurement date. The degree of judgment utilized in measuring the fair value of assets and liabilities generally

correlates to the level of pricing observability. Assets and liabilities with readily available, actively quoted prices

or for which fair value can be measured from actively quoted prices in active markets generally have more

pricing observability and require less judgment in measuring fair value. Conversely, assets and liabilities that are

rarely traded or not quoted have less pricing observability and are generally measured at fair value using

valuation models that require more judgment. These valuation techniques involve some level of management

estimation and judgment, the degree of which is dependent on the price transparency of the asset, liability or

market and the nature of the asset or liability. The Company has categorized its assets and liabilities measured at

fair value into a three-level hierarchy in accordance with this guidance. See “Note 3. Fair Value of Financial

Instruments and Non-Financial Assets” for further discussion regarding the Company’s measurement of assets

and liabilities at fair value.

Inventories and Deferred Charges

Inventories consist of devices and accessories not yet placed into service and units designated for the

replacement of damaged customer devices, and are stated at the lower of cost or market using the average cost

method. Devices sold to third party dealers and nationwide retailers are recorded as deferred charges upon

shipment of the devices by the Company. The deferred charges are recognized as cost of equipment when service

is activated by the customer.

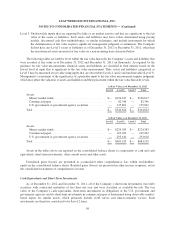

Property and Equipment

Property and equipment are initially recorded at cost. Additions and improvements are capitalized, while

expenditures that do not enhance the asset or extend its useful life are charged to operating expenses as incurred.

Depreciation is applied using the straight-line method over the estimated useful lives of the assets once the assets

are placed in service.

The following table summarizes the depreciable lives for property and equipment (in years):

Depreciable

Life

Network equipment:

Switches .............................................................. 5-10

Switch power equipment .................................................. 15

Cell site equipment and site improvements ................................... 5-7

Towers ................................................................ 15

Antennae .............................................................. 5

Computer hardware and software ............................................. 3-5

Furniture, fixtures retail and office equipment ................................... 3-7

The Company’s network construction expenditures are recorded as construction-in-progress until the

network or other asset is placed in service, at which time the asset is transferred to the appropriate property or

equipment category and depreciation commences. The Company capitalizes salaries and related costs of

engineering and technical operations employees as components of construction-in-progress during the

90