Cricket Wireless 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loss on Extinguishment of Debt

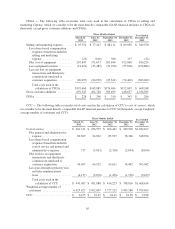

On October 10, 2012, in connection with our entry into the Credit Agreement, we issued a notice of

redemption to redeem all of our 10% unsecured senior notes due 2015 in accordance with the optional

redemption provisions governing the notes at a redemption price of 105% of the principal amount of outstanding

notes, plus accrued and unpaid interest to the redemption date. On November 9, 2012, we completed the

redemption for a total cash payment of $324.5 million and the indenture governing the notes was satisfied and

discharged in accordance with its terms. As a result of this redemption, we recognized a $18.6 million loss on

extinguishment of debt during the year ended December 31, 2012, which was comprised of $15.0 million in

redemption premium, $3.5 million in unamortized debt issuance costs and $0.1 million in professional fees.

During the year ended December 31, 2011, we did not have any extinguishment of debt.

In connection with our issuance of $1,200 million of 7.75% senior notes due 2020 in November 2010, we

repurchased and redeemed all of our outstanding $1,100 million in aggregate principal amount of 9.375% senior

notes due 2014 through a tender offer and redemption, respectively, and the indenture governing such senior

notes was satisfied and discharged in accordance with its terms. As a result, we recognized a $54.5 million loss

on extinguishment of debt during the year ended December 31, 2010, which was comprised of $46.6 million in

tender offer consideration (including $18.3 million in consent payments), $8.6 million in redemption premium,

$1.1 million in dealer manager fees, $10.7 million in unamortized debt issuance costs and $0.2 million in related

professional fees, net of $12.7 million in unamortized premium.

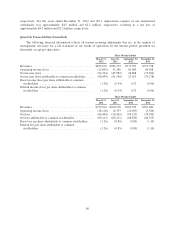

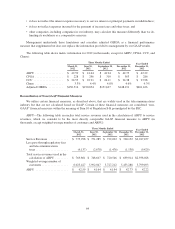

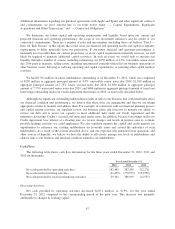

Income Tax Expense

During the year ended December 31, 2012, we recorded income tax expense of $57.9 million compared to

income tax expense of $39.4 million for the year ended December 31, 2011. The $18.5 million increase in

income tax expense was primarily due to a $2.5 million increase in tax expense associated with the amortization

of wireless licenses, a $5.7 million increase in tax expense from the deferred tax effects of our investment in STX

Wireless, and a nonrecurring $19.9 million increase of tax expense associated with the reversal of deferred tax

liabilities related to our wireless licenses, partially offset by a nonrecurring $9.5 million net tax benefit associated

with the reversal of deferred tax liabilities related to our investment in Savary Island. Both nonrecurring items

were primarily associated with the spectrum transactions that were consummated with Verizon Wireless in

August 2012 and with T-Mobile in October 2012.

During the year ended December 31, 2011, we recorded income tax expense of $39.4 million compared to

income tax expense of $42.5 million recognized in the corresponding period of the prior year. The decrease in

income tax expense during the year ended December 31, 2011 compared to the prior year period was primarily

due to a $23.3 million decrease in income tax expense due to the deferred tax effects of our joint venture

investments, offset in part by a net $6.3 million increase in the current year associated with both the amortization

of wireless licenses and the deferred tax effects of license exchange transactions entered into with T-Mobile. In

addition, during the year ended December 31, 2010, we recorded a $15.5 million income tax benefit in

connection with the impairment of our goodwill.

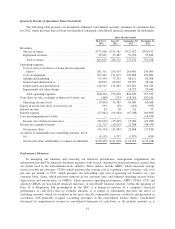

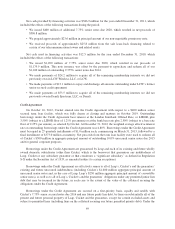

Unrestricted Subsidiaries

In July 2011, Leap’s board of directors designated Cricket Music Holdco, LLC (a wholly-owned subsidiary

of Cricket, or Cricket Music) and Cricket Music’s wholly-owned subsidiary Muve USA, LLC, or Muve USA, as

“Unrestricted Subsidiaries” under the indentures governing our senior notes. Cricket Music, Muve USA and their

subsidiaries are also designated as “Unrestricted Subsidiaries” under the Credit Agreement. Cricket Music and

Muve USA hold certain hardware, software and intellectual property relating to our Muve Music service. During

the years ended December 31, 2012 and 2011, Cricket Music and Muve USA had no operations or revenues.

Therefore, the most significant components of the financial position and results of operations of our unrestricted

subsidiaries were property and equipment and depreciation expense. As of December 31, 2012 and December 31,

2011, property and equipment of our unrestricted subsidiaries was approximately $4.9 million and $9.4 million,

59