Cricket Wireless 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

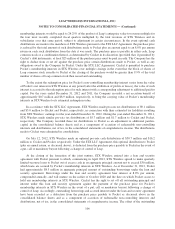

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

than its carrying value and is measured as the amount by which the license’s carrying value exceeds its fair value.

Any required impairment loss would be recorded as a reduction in the carrying value of the relevant wireless

licenses and charged to results of operations. As more fully described below, the fair value of the Company’s

wireless licenses was determined using Level 3 inputs in accordance with the authoritative guidance for fair

value measurements.

The valuation method the Company uses to determine the fair value of its wireless licenses is the market

approach. Under this method, the Company determines fair value by reviewing sales prices of other wireless

licenses of similar size and type that have been recently sold through government auctions and private transactions.

As part of this market-level analysis, the fair value of each wireless license is also evaluated and adjusted for

developments or changes in legal, regulatory and technical matters, and for demographic and economic factors,

such as population size, unemployment rates, composition, growth rate and density, household and disposable

income, and composition and concentration of the market’s workforce in industry sectors identified as wireless-

centric (for example, real estate, transportation, professional services, agribusiness, finance and insurance).

In connection with the Company’s 2012 annual impairment test, the aggregate fair value and carrying value

of the Company’s operating wireless licenses (excluding assets held for sale) were $2,415.0 million and $1,745.7

million, respectively, as of September 30, 2012. No impairment charges were recorded during the years ended

December 31, 2012 or 2011 with respect to the Company’s operating wireless licenses as the aggregate fair value

of these licenses exceeded their aggregate carrying value as of such dates. If the fair value of the Company’s

operating wireless licenses had declined by 10%, the Company would not have recognized any impairment loss.

In connection with the Company’s 2012 annual impairment test, the aggregate fair value and carrying value

of the Company’s non-operating wireless licenses (excluding assets held for sale) were $77.9 million and $42.6

million, respectively, as of September 30, 2012. The Company did not record any impairment charges during the

year ended December 31, 2012 to reduce the carrying value of any non-operating wireless license to its estimated

fair value. If the fair value of the Company’s non-operating wireless licenses had each declined by 10%, the

Company would have recognized an impairment loss of approximately $0.1 million. The Company recorded an

impairment charge of $0.4 million during the year ended December 31, 2011 to reduce the carrying value of

certain non-operating wireless licenses to their estimated fair values.

The Company evaluated whether any triggering events or changes in circumstances occurred subsequent to

the 2012 annual impairment test of its wireless licenses that indicate that an impairment condition may exist. This

evaluation included consideration of whether there had been any significant adverse change in legal factors or in

the Company’s business climate, adverse action or assessment by a regulator, unanticipated competition, loss of

key personal or likely sale or disposal of all or a significant portion of an asset group. Based upon this evaluation,

the Company concluded that no triggering events or changes in circumstances had occurred.

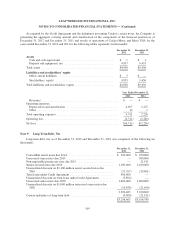

Goodwill

The Company records the excess of the purchase price over the fair value of net assets acquired in a business

combination as goodwill. As of December 31, 2012 and 2011, goodwill of $31.9 million, primarily represented the

excess of the purchase price over the fair values of the assets acquired (net of liabilities assumed, including the

related deferred tax effects) by STX Wireless from Pocket in connection with the formation of the joint venture.

On January 3, 2011, the Company acquired a customer assistance call center from various entities doing

business as Pocket Communications (“Pocket”) for $850,000. The Company accounted for this transaction as a

business purchase combination in accordance with the authoritative guidance for business combinations. A portion

of the purchase price was assigned to property and equipment and the remaining amount was allocated to goodwill.

102