Cricket Wireless 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Savary Island Venture

Cricket formerly owned an 85% non-controlling membership interest in Savary Island, which held wireless

spectrum in the upper Midwest portion of the U.S. and which leased a portion of that spectrum to us. The

remaining 15% controlling interest was held by Ring Island Wireless, LLC, or Ring Island. In May 2012, Ring

Island exercised its right to put its entire controlling membership interest in Savary Island to Cricket, and in

October 2012, Cricket acquired Ring Island’s 15% controlling interest for approximately $5.3 million in cash. In

December 2012, Savary Island and its subsidiaries were merged with and into Cricket, with Cricket as the

surviving entity.

Cricket, Savary Island and Savary Island’s wholly-owned subsidiaries were party to an Amended and

Restated Credit Agreement, dated as of December 27, 2010, or the Savary Island Credit Agreement, pursuant to

which Savary Island had assumed approximately $211.6 million of the outstanding loans then owed to Cricket by

a subsidiary of Denali in connection with the contribution of certain wireless spectrum by a subsidiary of Denali

to Savary Island. Under the Savary Island Credit Agreement, Cricket had also agreed to loan Savary Island up to

$5.0 million to fund its working capital needs. Immediately prior to Cricket’s acquisition of Ring Island’s

controlling membership interest in Savary Island, the outstanding borrowings under the Savary Island Credit

Agreement (including accrued interest), after giving effect to various repayments and debt cancellations made in

connection with the closing of spectrum transactions involving Savary Island, totaled approximately $12.5

million. In connection with Cricket’s acquisition of Ring Island’s controlling membership interest, all remaining

indebtedness under the Savary Island Credit Agreement was converted into equity in Savary Island and the

Savary Island Credit Agreement and all related loan and security documents were terminated.

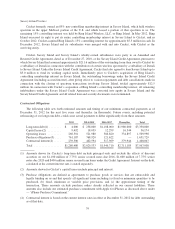

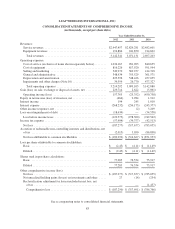

Contractual Obligations

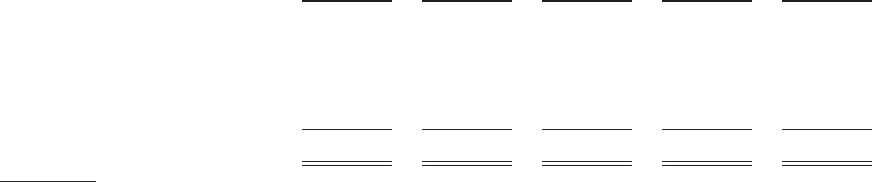

The following table sets forth estimated amounts and timing of our minimum contractual payments as of

December 31, 2012 for the next five years and thereafter (in thousands). Future events, including potential

refinancing of our long-term debt, could cause actual payments to differ significantly from these amounts.

2013 2014-2015 2016-2017 Thereafter Total

Long-term debt(1) ........ $ 4,000 $ 258,000 $1,108,000 $1,980,000 $3,350,000

Capital leases(2) ......... 9,492 18,039 12,299 16,344 56,174

Operating leases ......... 266,301 521,980 386,820 334,897 1,509,998

Purchase obligations(3) .... 761,187 768,920 121,622 — 1,651,729

Contractual interest(4) ..... 239,500 462,594 317,969 379,944 1,400,007

Total .................. $1,280,480 $2,029,533 $1,946,710 $2,711,185 $7,967,908

(1) Amounts shown for Cricket’s long-term debt include principal only and exclude the effects of discount

accretion on our $1,100 million of 7.75% senior secured notes due 2016, $1,600 million of 7.75% senior

notes due 2020 and $400 million senior secured term loans under the Credit Agreement. Interest on the debt,

calculated at the current interest rate, is stated separately.

(2) Amounts shown for Cricket’s capital leases include principal and interest.

(3) Purchase obligations are defined as agreements to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms including (a) fixed or minimum quantities to be

purchased, (b) fixed, minimum or variable price provisions, and (c) the approximate timing of the

transaction. These amounts exclude purchase orders already reflected in our current liabilities. These

amounts also include our estimated purchase commitment with Apple for iPhones as discussed above under

— “iPhone Purchase Commitment.”

(4) Contractual interest is based on the current interest rates in effect at December 31, 2012 for debt outstanding

as of that date.

79