Cricket Wireless 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

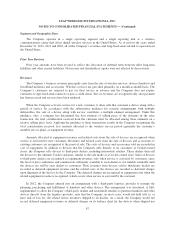

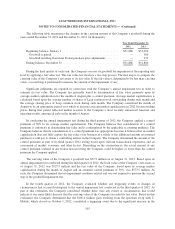

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

impairment test is conducted each year during the third quarter. In addition, on a quarterly basis, the Company

evaluates the triggering event criteria outlined in the authoritative guidance for intangible assets to determine

whether events or changes in circumstances indicate that an impairment condition may exist. Refer to “Note 5.

Wireless Licenses and Goodwill” for further discussion regarding the Company’s goodwill impairment

evaluation.

Investments in Other Entities

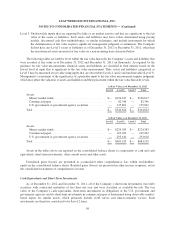

The Company uses the equity method to account for investments in common stock of corporations in which

it has a voting interest of between 20% and 50% or in which the Company otherwise has the ability to exercise

significant influence, and for investments in limited liability companies that maintain specific ownership

accounts in which it has more than a minor but not greater than a 50% ownership interest. Under the equity

method, the investment is originally recorded at cost and is adjusted to recognize the Company’s share of net

earnings or losses of the investee. The Company’s ownership interest in equity method investees ranges from

approximately 6% to 20% of outstanding membership units. The carrying value of the Company’s investments in

its equity method investees was $10.6 million and $11.0 million as of December 31, 2012 and 2011, respectively.

During the years ended December 31, 2012, 2011 and 2010, the Company’s share of earnings in its equity

method investees (net of its share of their losses) was $(0.5) million, $3.0 million and $1.9 million, respectively.

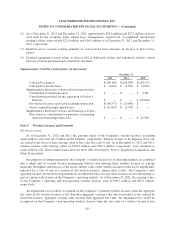

On June 30, 2011, one of the Company’s equity method investees declared a cash dividend and paid the

dividend with funds borrowed under a third-party line of credit. The Company’s share of the dividend based on

its ownership percentage was $18.2 million and was received in full on July 1, 2011. In the consolidated

statement of cash flows for the year ended December 31, 2011, the Company presented the portion of the

dividend equal to its share of accumulated profits (approximately $6.6 million) as cash from operating activities

and the remainder (approximately $11.6 million) as cash from investing activities, as it represented a return of

the Company’s original investment.

The Company regularly monitors and evaluates the realizable value of its investments. When assessing an

investment for an other-than-temporary decline in value, the Company considers such factors as, among other

things, the performance of the investee in relation to its business plan, the investee’s revenue and cost trends,

liquidity and cash position, market acceptance of the investee’s products or services, any significant news that

has been released regarding the investee and the outlook for the overall industry in which the investee operates. If

events and circumstances indicate that a decline in the value of these assets has occurred and is other-than-

temporary, the Company records a reduction to the carrying value of its investment and a corresponding charge

to the consolidated statements of comprehensive income.

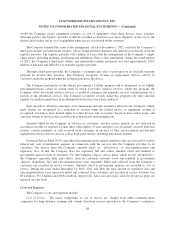

Concentrations

The Company generally relies on one key vendor for billing and Muve Music royalty services, a limited

number of vendors for device logistics, a limited number of vendors for its voice and data communications

transport services and a limited number of vendors for payment processing services. Loss or disruption of these

services could materially adversely affect the Company’s business.

The networks the Company operates do not, by themselves, provide national coverage and it must pay fees

to other carriers who provide roaming or wholesale services to the Company. The Company currently relies on

roaming agreements with several carriers for the majority of its voice services and generally on one key carrier

for its data roaming services. The Company has also entered into a wholesale agreement, which the Company

uses to offer Cricket services in nationwide retailers outside of its current network footprint. If the Company

93