Cricket Wireless 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

At December 31, 2012, the Company estimated it had federal and state NOL carryforwards of

approximately $2.6 billion and $2.0 billion, respectively (which begin to expire in 2022 for federal income tax

purposes and of which $69.8 million will expire at the end of 2013 for state income tax purposes). During the

year ended December 31, 2012, $37.2 million of the Company’s state NOLs expired. Included in the Company’s

federal and state net operating loss carryforwards are $24.6 million of losses which, when utilized, will increase

additional paid-in capital by approximately $9.4 million.

The Company’s ability to utilize NOLs could be limited if it were to experience an “ownership change,” as

defined in Section 382 of the Internal Revenue Code and similar state provisions. In general terms, an ownership

change can occur whenever there is a cumulative shift in the ownership of a company by more than

50 percentage points by one or more “5% stockholders” within a three-year period. The occurrence of such a

change in the Company’s ownership would limit the amount of NOL carryforwards it could utilize in a given

year. This limitation would accelerate cash tax payments the Company would be required to make and likely

result in a substantial portion of its NOLs expiring before the Company could fully utilize them.

In 2011, trading in Leap common stock increased the risk of an ownership change under Section 382 of the

Internal Revenue Code. Accordingly, on August 30, 2011, the Company’s board of directors adopted a Tax

Benefit Preservation Plan to help deter acquisitions of Leap common stock that could result in an ownership

change under Section 382 and thus help preserve the Company’s ability to use its NOL carryforwards. The Tax

Benefit Preservation Plan is designed to deter acquisitions of Leap common stock that would result in a

stockholder owning 4.99% or more of Leap common stock (as calculated under Section 382), or any existing

holder of 4.99% or more of Leap common stock acquiring additional shares, by substantially diluting the

ownership interest of any such stockholder unless the stockholder obtains an exemption from the Company’s

board of directors.

None of the Company’s NOL carryforwards are being considered as an uncertain tax position or disclosed

as an unrecognized tax benefit. Any carryforwards that expire prior to utilization as a result of a Section 382

limitation will be removed from deferred tax assets with a corresponding reduction to valuation allowance. Since

the Company currently maintains a full valuation allowance against its federal and state NOL carryforwards, it

does not expect that any possible limitation would have a current impact on its results of operations.

In accordance with the authoritative guidance for business combinations, which became effective for the

Company on January 1, 2009, any reduction in the valuation allowance, including the valuation allowance

established in fresh-start reporting, will be accounted for as a reduction of income tax expense.

The Company’s unrecognized income tax benefits and uncertain tax positions, as well as any associated

interest and penalties, are recorded through income tax expense; however, such amounts have not been

significant in any period. All of the Company’s tax years from 1998 to 2011 remain open to examination by

federal and state taxing authorities. In July 2009, the federal examination of the Company’s 2005 tax year, which

was limited in scope, was concluded and the results did not have a material impact on the consolidated financial

statements.

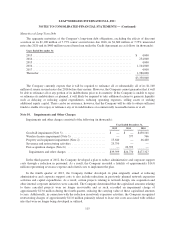

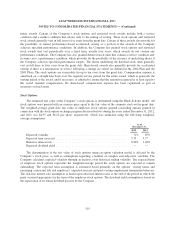

Note 12. Share-based Compensation

The Company allows for the grant of stock options, restricted stock awards and deferred stock units to

employees, independent directors and consultants under its 2004 Stock Option, Restricted Stock and Deferred

Stock Unit Plan (the “2004 Plan”) and its 2009 Employment Inducement Equity Incentive Plan (the “2009

Plan”). As of December 31, 2012, a total of 10,075,000 aggregate shares of common stock were reserved for

issuance under the 2004 Plan and 2009 Plan, of which 1,195,419 shares of common stock were available for

118