Cricket Wireless 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additional information regarding our purchase agreements with Apple and Sprint and other significant contracts

and commitments we have entered into is set forth below under “— Capital Expenditures, Significant

Acquisitions and Other Transactions” and “— Contractual Obligations”.

We determine our future capital and operating requirements and liquidity based upon our current and

projected financial and operating performance, the scope of our investment initiatives and the extent of our

contractual commitments. There are a number of risks and uncertainties (including those set forth in “Part I —

Item 1A. Risk Factors” of this report) that could cause our financial and operating results and capital or liquidity

requirements to differ materially from our projections. If our future financial and operating performance is

materially less favorable than our current projections, or if our capital requirements materially increase, we will

likely be required to generate additional capital resources. In such an event, we would seek to increase our

liquidity through a number of actions, including refinancing our $250 million of 4.5% convertible senior notes

due 2014 prior to maturity; selling assets, including spectrum not currently utilized in our business operations or

other business assets; delaying or reducing operating and capital expenditures; or pursuing other capital markets

activities.

We had $3,302 million in senior indebtedness outstanding as of December 31, 2012, which was comprised

of $250 million in aggregate principal amount of 4.5% convertible senior notes due 2014, $1,100 million in

aggregate principal amount of 7.75% senior secured notes due 2016, $1,600 million in aggregate principal

amount of 7.75% unsecured senior notes due 2020, and $400 million in aggregate principal amount of term loan

borrowings outstanding under our Credit Agreement that mature in 2019, as more fully described below.

Although our significant outstanding indebtedness results in risks to our business that could materially affect

our financial condition and performance, we believe that these risks are manageable and that we are taking

appropriate actions to monitor and address them. For example, in connection with our financial planning process

and capital raising activities, we regularly review our business plans and forecasts to monitor our ability to

service our debt and to assess our capacity to incur additional debt under our Credit Agreement and the

indentures governing Cricket’s secured and unsecured senior notes. In addition, because borrowings under our

Credit Agreement bear interest at a floating rate, we review changes and trends in interest rates to evaluate

possible hedging activities we could implement. We also regularly monitor the capital and credit markets for

opportunities to refinance our existing indebtedness on favorable terms and extend the maturities of such

indebtedness. As a result of the actions described above, and our expected cash generated from operations and

other sources of liquidity, we believe we have the ability to effectively manage our levels of indebtedness and

address risks to our business and financial condition related to our indebtedness.

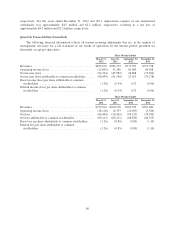

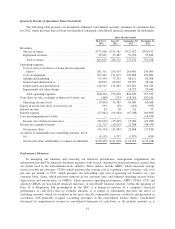

Cash Flows

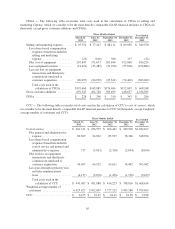

The following table shows cash flow information for the three years ended December 31, 2012, 2011 and

2010 (in thousands):

Year Ended December 31,

2012 2011 2010

Net cash provided by operating activities .................... 182,445 387,509 312,278

Net cash used in investing activities ........................ (41,479) (779,975) (123,952)

Net cash provided by (used in) financing activities ............ 29,341 386,919 (12,535)

Operating Activities

Net cash provided by operating activities decreased $205.1 million, or 52.9%, for the year ended

December 31, 2012 compared to the corresponding period of the prior year. This decrease was primarily

attributable to changes in working capital.

67