Cricket Wireless 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

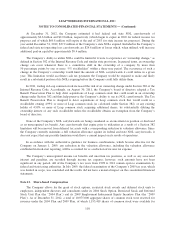

The notes and the guarantees are effectively senior to all of Leap’s, Cricket’s and the guarantors’ existing

and future unsecured indebtedness (including Cricket’s $1,600 million aggregate principal amount of unsecured

senior notes and, in the case of Leap, Leap’s $250 million aggregate principal amount of convertible senior

notes), as well as to all of Leap’s, Cricket’s and the guarantors’ obligations under any permitted junior lien debt

that may be incurred in the future, in each case to the extent of the value of the collateral securing the notes and

the guarantees.

The notes and the guarantees are secured on a first-priority basis, equally and ratably with the Credit

Agreement and any future parity lien debt, by liens on substantially all of the present and future personal

property of Leap, Cricket and the guarantors, except for certain excluded assets and subject to permitted liens

(including liens on the collateral securing any future permitted priority debt). Under the senior secured notes

indenture, Leap, Cricket and the guarantors are permitted to incur debt under existing and future secured credit

facilities in an aggregate principal amount outstanding (including the aggregate principal amount outstanding of

the notes and under the Credit Agreement) of up to the greater of $1,500 million and 2.5 times Leap’s

consolidated cash flow (excluding the consolidated cash flow of STX Wireless and Cricket Music) for the prior

four fiscal quarters.

The notes and the guarantees are effectively junior to all of Leap’s, Cricket’s and the guarantors’ obligations

under any permitted priority debt that may be incurred in the future (up to the lesser of 0.30 times Leap’s

consolidated cash flow (excluding the consolidated cash flow of STX Wireless and Cricket Music) for the prior

four fiscal quarters and $300 million in aggregate principal amount outstanding), to the extent of the value of the

collateral securing such permitted priority debt, as well as to existing and future liabilities of Leap’s and

Cricket’s subsidiaries that are not guarantors (including STX Wireless and Cricket Music and their respective

subsidiaries). In addition, the notes and the guarantees are senior in right of payment to any of Leap’s, Cricket’s

and the guarantors’ future subordinated indebtedness.

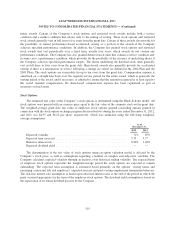

The notes may be redeemed, in whole or in part, at any time, at a redemption price of 103.875% and

101.938% of the principal amount thereof if redeemed during the twelve months beginning on May 15, 2013 and

2014, respectively, or at 100% of the principal amount if redeemed during the twelve months beginning on

May 15, 2015 or thereafter, plus accrued and unpaid interest thereon to the redemption date.

If a “change of control” occurs (which includes the acquisition of beneficial ownership of 35% or more of

Leap’s equity securities (other than a transaction where immediately after such transaction Leap will be a wholly-

owned subsidiary of a person of which no person or group is the beneficial owner of 35% or more of such

person’s voting stock), a sale of all or substantially all of the assets of Leap and its restricted subsidiaries and a

change in a majority of the members of Leap’s board of directors that is not approved by the board), each holder

of the notes may require Cricket to repurchase all of such holder’s notes at a purchase price equal to 101% of the

principal amount of the notes, plus accrued and unpaid interest thereon to the repurchase date.

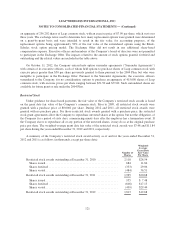

Unsecured Senior Notes Due 2020

In November 2010, Cricket issued $1,200 million of 7.75% unsecured senior notes due 2020 in a private

placement to institutional buyers at an issue price of 98.323% of the principal amount, which were exchanged in

January 2011 for identical notes that had been registered with the SEC. The $20.1 million discount to the net

proceeds the Company received in connection with the issuance of the notes has been recorded in long-term debt,

net in the consolidated financial statements and is being accreted as an increase to interest expense over the term

of the notes. In May 2011, Cricket issued an additional $400 million of 7.75% unsecured senior notes due 2020

in a private placement to institutional buyers at an issue price of 99.193% of the principal amount, which were

113