Cricket Wireless 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Although the Tax Benefit Preservation Plan is intended to reduce the likelihood of an adverse ownership

change under Section 382, the Tax Benefit Preservation Plan may not prevent such an ownership change from

occurring and does not protect against all transactions that could cause an ownership change, such as sales of

Leap common stock by certain greater than 5% stockholders or transactions that occurred prior to the adoption of

the Tax Benefit Preservation Plan. Accordingly, we cannot assure you that an ownership change under

Section 382 will not occur and significantly limit the use of our NOLs.

Our Business and Stock Price May Be Adversely Affected if Our Internal Controls Are Not Effective.

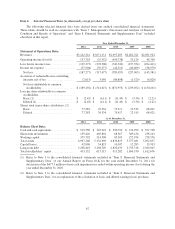

Section 404 of the Sarbanes-Oxley Act of 2002 requires companies to conduct a comprehensive evaluation

of their internal control over financial reporting. To comply with this statute, each year we are required to

document and test our internal control over financial reporting; our management is required to assess and issue a

report concerning our internal control over financial reporting; and our independent registered public accounting

firm is required to report on the effectiveness of our internal control over financial reporting.

In our quarterly and annual reports (as amended) for the periods ended from December 31, 2006 through

September 30, 2008, we reported a material weakness in our internal control over financial reporting, which

related to the design of controls over the preparation and review of the account reconciliations and analysis of

revenues, cost of revenues and deferred revenues, and ineffective testing of changes made to our revenue and

billing systems in connection with the introduction or modification of service offerings. In addition, we

previously reported that certain material weaknesses in our internal control over financial reporting existed at

various times during the period from September 30, 2004 through September 30, 2006. These material

weaknesses included excessive turnover and inadequate staffing levels in our accounting, financial reporting and

tax departments, weaknesses in the preparation of our income tax provision, and weaknesses in our application of

lease-related accounting principles, fresh-start reporting oversight, and account reconciliation procedures.

Although we believe we took appropriate actions to remediate the control deficiencies we identified and to

strengthen our internal control over financial reporting, we cannot assure you that we will not discover other

material weaknesses in the future or that no material weakness will result from any difficulties, errors, delays or

disruptions while we implement and transition to significant new internal systems, including the recent transition

to our new customer billing system. The existence of one or more material weaknesses could result in errors in

our financial statements, and substantial costs and resources may be required to rectify these or other internal

control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our

reported financial information, the market price of Leap common stock could decline significantly, we may be

unable to obtain additional financing to operate and expand our business, and our business and financial

condition could be harmed.

Related to Ownership of Leap Common Stock

Our Stock Price May Be Volatile, and You May Lose All or Some of Your Investment.

The trading prices of the securities of telecommunications companies have been highly volatile.

Accordingly, the trading price of Leap common stock has been, and is likely to continue to be, subject to wide

fluctuations. Factors affecting the trading price of Leap common stock may include, among other things:

• variations in our operating results or those of our competitors;

• announcements of technological innovations, new services or service enhancements, strategic alliances or

significant agreements by us or by our competitors;

• entry of new competitors into our markets, changes in product and service offerings by us or our

competitors, changes in the prices charged for product and service offerings by us or our competitors, or

changes or upgrades in the network technologies used by us or our competitors;

36