Cricket Wireless 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Depreciation and Amortization

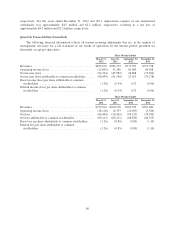

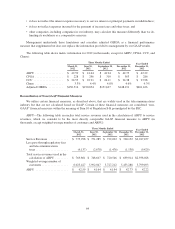

Depreciation and amortization expense increased $77.2 million, or 14.1%, for the year ended December 31,

2012 compared to the prior year. The increase in depreciation and amortization expense was due primarily to

network upgrades, which related, in part, to our deployment of next-generation LTE technology.

Depreciation and amortization expense increased $91.4 million or 20.0%, for the year ended

December 31, 2011 compared to the prior year. The increase in depreciation and amortization expense was due

primarily to the expansion and upgrade of our network and corporate platforms as well as depreciation and

amortization expense related to the assets that Pocket contributed to STX Wireless in connection with the

formation of our South Texas joint venture in October 2010.

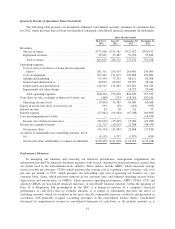

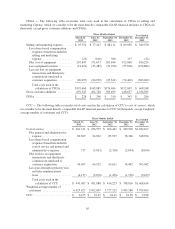

Impairments and Other Charges

During the year ended December 31, 2012, we incurred approximately $39.4 million in impairments and

other charges related to reducing our cost structure and exiting certain activities. During the third quarter of 2012,

we recorded approximately $14.8 million in severance expenses and related costs to implement our plan to

reduce administrative and corporate support costs through a reduction in personnel. Additionally, in connection

with our plans to reduce our previously planned network expansion activities and overall capital expenditures,

certain plans for network design, site acquisition and internal corporate programming and development were

canceled. Therefore, we determined that certain capitalized amounts were no longer recoverable, and as such,

recorded an impairment charge of $13.6 million, writing the carrying value of those capitalized amounts down to

zero. Additionally, in connection with the reduction in network expansion activities, we recognized restructuring

charges of approximately $11.0 million primarily related to lease exit costs associated with cell sites that were no

longer being developed or utilized.

During the year ended December 31, 2011, we incurred approximately $26.4 million of integration charges

relating primarily to certain leased cell site and retail store locations contributed to our joint venture STX

Wireless in the South Texas region that it no longer uses.

During the year ended December 31, 2010, we recorded impairments and other charges of approximately

$477.3 million, primarily related to a goodwill impairment charge of $430.1 million, as a result of our annual

impairment testing conducted during the third quarter of 2010. In addition we recorded an impairment charge of

$46.5 million during the year ended December 31, 2010, as a result of our determination to spend an increased

portion of our planned capital expenditures on the deployment of next-generation LTE technology and to defer

our previously planned network expansion activities. These costs were previously included in construction-in-

progress, for certain network design, site acquisition and interest costs capitalized during the construction period.

No impairment charges were recorded during the year ended December 31, 2012 with respect to our

wireless licenses. As a result of our annual impairment testing of our wireless licenses conducted during the third

quarters of 2011 and 2010, we recorded impairment charges of $0.4 million and $0.8 million, respectively, to

reduce the carrying value of certain non-operating wireless licenses to their fair value. No such impairment

charges were recorded with respect to our operating wireless licenses for either period, as the aggregate fair

values of these licenses exceeded their aggregate carrying value.

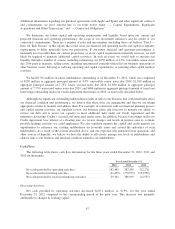

Gain (Loss) on Sale, Exchange or Disposal of Assets, Net

Gain (loss) on sale, exchange or disposal of assets, net reflects the net gain or loss recognized upon the

disposal of certain of our property and equipment and wireless licenses. During the year ended December 31,

2012, we recognized a net gain of $229.7 million. We recorded a gain of approximately $236.8 million related to

the sale of spectrum to Verizon Wireless and exchange of spectrum with T-Mobile. For more information

regarding these transactions, see the discussion below under “Liquidity and Capital Resources — Capital

Expenditures, Significant Acquisitions and Other Transactions.” This gain was partially offset by a loss of

approximately $7.2 million relating to the disposal of certain property and equipment.

57