Cricket Wireless 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

purchase commitment for that particular year is credited to the next succeeding year. However, to the extent the

Company’s revenues were to fall beneath the applicable commitment amount for any given year, excess revenues

from a subsequent year could not be carried back to offset such shortfall.

The Company’s obligation to provide the minimum purchase amount for any calendar year is subject to

Sprint’s compliance with specified covenants in the wholesale agreement. Based upon a review of information

provided to the Company by Sprint, the Company informed Sprint that certain of those covenants had not been

met in 2012 and that, as a result, the Company was not subject to the minimum purchase commitment for 2012.

Sprint disputed that assertion. In February 2013, the parties resolved this matter.

In addition, in the event Leap is involved in a change-of-control transaction with another facilities-based

wireless carrier with annual revenues of at least $500 million in the fiscal year preceding the date of the change

of control agreement (other than MetroPCS Communications, Inc. (“MetroPCS”)), either the Company (or the

Company’s successor in interest) or Sprint may terminate the wholesale agreement within 60 days following the

closing of such a transaction. In connection with any such termination, the Company (or its successor in interest)

would be required to pay to Sprint a specified percentage of the remaining aggregate minimum purchase

commitment, with the percentage to be paid depending on the year in which the change of control agreement was

entered into, being 20% for any such agreement entered into in 2013 and 10% for any such agreement entered

into in 2014 or 2015.

In the event that Leap is involved in a change-of-control transaction with MetroPCS during the term of the

wholesale agreement, then the agreement would continue in full force and effect, subject to certain revisions,

including, without limitation, an increase to the total minimum purchase commitment to $350 million, taking into

account any revenue contributed by Cricket prior to the date thereof. In the event Sprint is involved in a change-

of-control transaction, the agreement would bind Sprint’s successor-in-interest.

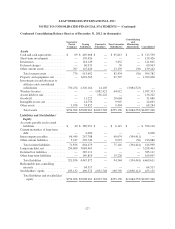

Capital and Operating Leases

The Company has entered into non-cancelable operating lease agreements to lease its administrative and

retail facilities, and sites for towers, equipment and antennae required for the operation of its wireless network.

These leases typically include renewal options and escalation clauses, some of which escalation clauses are based

on the consumer price index. In general, site leases have 5- to 10-year initial terms with 4 5-year renewal options.

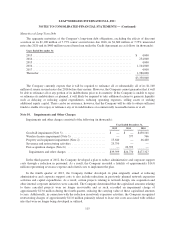

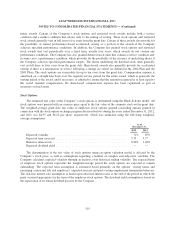

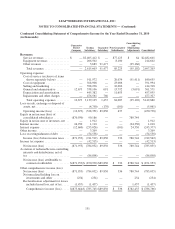

The following table summarizes the approximate future minimum rentals under non-cancelable operating

leases, including renewals that are reasonably assured, and future minimum capital lease payments in effect at

December 31, 2012 (in thousands):

Years Ended December 31:

Capital

Leases

Operating

Leases

2013 ......................................................... $ 9,492 $ 266,301

2014 ......................................................... 9,492 265,201

2015 ......................................................... 8,547 256,778

2016 ......................................................... 7,030 211,464

2017 ......................................................... 5,268 175,357

Thereafter .................................................... 16,344 334,897

Total minimum lease payments ................................... $56,173 $1,509,998

Less amounts representing interest ................................. (13,277)

Present value of minimum lease payments ........................... $42,896

125