Cricket Wireless 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• prohibit stockholder action by written consent, and require that all stockholder actions be taken at a

meeting of our stockholders;

• provide that the board of directors is expressly authorized to make, alter or repeal our bylaws; and

• establish advance notice requirements for nominations for elections to our board or for proposing matters

that can be acted upon by stockholders at stockholder meetings.

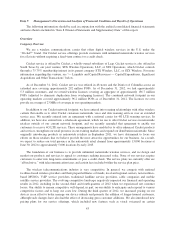

We are also subject to Section 203 of the Delaware General Corporation Law, which generally prohibits a

Delaware corporation from engaging in any of a broad range of business combinations with any “interested”

stockholder for a period of three years following the date on which the stockholder became an “interested”

stockholder and which may discourage, delay or prevent a change in control of our company.

In addition, under the indentures governing our secured and unsecured senior notes and convertible senior

notes, if certain “change of control” events occur, each holder of notes may require us to repurchase all of such

holder’s notes at a purchase price equal to 101% of the principal amount of secured or unsecured senior notes, or

100% of the principal amount of convertible senior notes, plus accrued and unpaid interest. In addition, our

Credit Agreement provides for an event of default upon the occurrence of a change of control. See

“Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations -

Liquidity and Capital Resources” of this report.

On August 30, 2011, our board of directors adopted a Tax Benefit Preservation Plan as a measure intended

to help deter acquisitions of Leap common stock that could result in an ownership change under Section 382 of

the Internal Revenue Code and thus help preserve our ability to use our NOL carryforwards. The Tax Benefit

Preservation Plan was approved by our stockholders in May 2012. The Tax Benefit Preservation Plan is designed

to deter acquisitions of Leap common stock that would result in a stockholder owning 4.99% or more of Leap

common stock (as calculated under Section 382), or any existing holder of 4.99% or more of Leap common stock

acquiring additional shares, by substantially diluting the ownership interest of any such stockholder unless the

stockholder obtains an exemption from our board of directors. Because the Tax Benefit Preservation Plan may

restrict a stockholder’s ability to acquire Leap common stock, it could discourage a tender offer for Leap

common stock or make it more difficult for a third party to acquire a controlling position in our stock without our

approval, and the liquidity and market value of Leap common stock may be adversely affected while the Tax

Benefit Preservation Plan is in effect.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

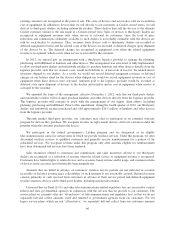

As of December 31, 2012, we leased approximately 9,700 cell sites, 23 switching centers and four

warehouse facilities (which range in size from approximately 4,000 square feet to 18,000 square feet). In

addition, we had 48 office leases in our individual markets that range from approximately 500 square feet to

approximately 40,000 square feet. We also leased approximately 230 retail locations in our markets, including

stores ranging in size from approximately 800 square feet to 11,000 square feet.

As of December 31, 2012, we leased office space totaling approximately 200,000 square feet for our

corporate headquarters in San Diego. We use these offices for engineering and administrative purposes. As of

such date, we also leased space, totaling approximately 130,000 square feet, for our facility in Denver for sales

and marketing, product development, supply chain, engineering and information technology functions. We do not

own any real property.

39