Blackberry 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235

|

|

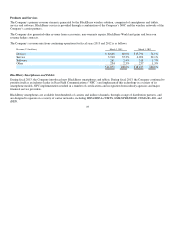

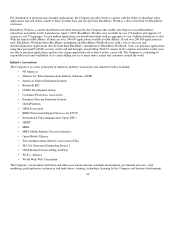

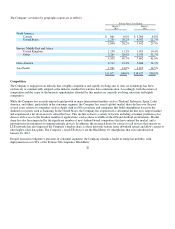

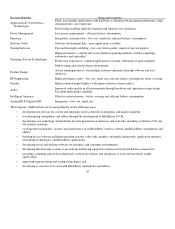

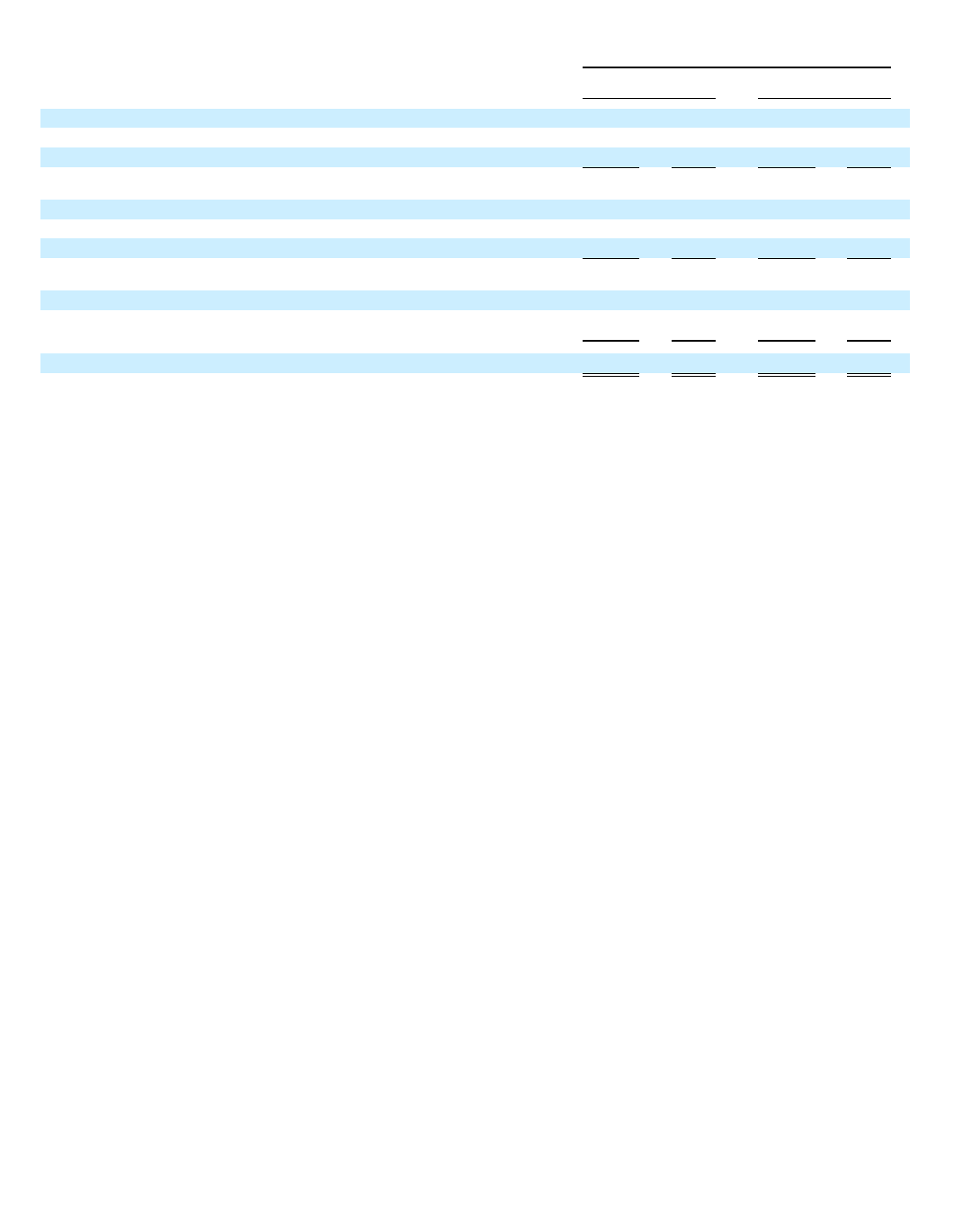

The Company’s revenues by geographic region are as follows:

Competition

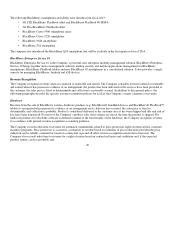

The Company is engaged in an industry that is highly competitive and rapidly evolving and, to date, no technology has been

exclusively or commercially adopted as the industry standard for wireless data communication. Accordingly, both the nature of

competition and the scope of the business opportunities afforded by this market are currently evolving, uncertain and highly

competitive.

While the Company has recently enjoyed rapid growth in many international markets such as Thailand, Indonesia, Spain, Latin

America, and others, particularly in the consumer segment, the Company has seen its global market share decline over the past

several years relative to companies such as Apple with its iOS ecosystem, and companies that build smartphones based on the

Android ecosystem, such as Samsung. In the United States, the Company has experienced a substantial decline in its largest market

and experienced a net decrease in its subscriber base. This decline is due to a variety of factors including consumer preferences for

devices with access to the broadest number of applications, such as those available in the iOS and Android environments. Market

share has also been impacted by the significant number of new Android-based competitors that have entered the market, and a

growing trend in enterprises to support multiple devices. In addition, the increased desire by carriers to sell devices that operate on

LTE networks has also impacted the Company’s market share, as these networks feature faster download speeds and allow carriers to

offer higher-value data plans. The Company’s first LTE devices are the BlackBerry 10 smartphones that were introduced on

January 30, 2013.

Despite increased competitive pressures in consumer segments, the Company remains a leader in enterprise mobility, with

deployments in over 90% of the Fortune 500 companies. BlackBerry

26

For the Fiscal Year Ended

March 2,

2013

March 3,

2012

North America

Canada

$ 661 6.0% $ 1,260 6.8%

United States

2,235 20.2% 4,182 22.7%

2,896 26.2% 5,442

29.5%

Euro

p

e, Middle East and Africa

United Kin

g

dom

1,238 11.2% 1,919

10.4%

Other

3,264 29.5% 5,743 31.2%

4,502 40.7% 7,662

41.6%

Latin America

2,114 19.1% 2,646 14.4%

Asia Pacific

1,561 14.

0

% 2,673

14.5%

$11,073 100.

0

% $18,423 100.0%