Blackberry 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

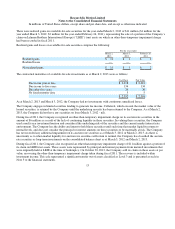

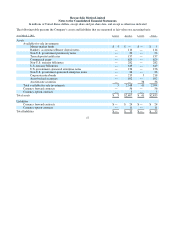

There were realized gains on available-for-sale securities for the year ended March 2, 2013 of $11 million ($1 million for the

year ended March 3, 2012; $2 million for the year ended February 26, 2011), representing the sale of a portion of the Company’s

claim on Lehman Brothers International (Europe) (“LBIE”) trust assets on which an other-than-temporary impairment charge

had been recorded in fiscal 2011.

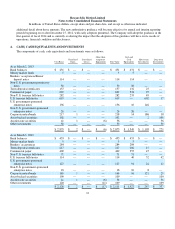

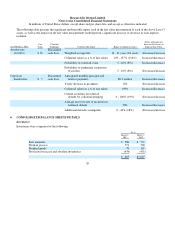

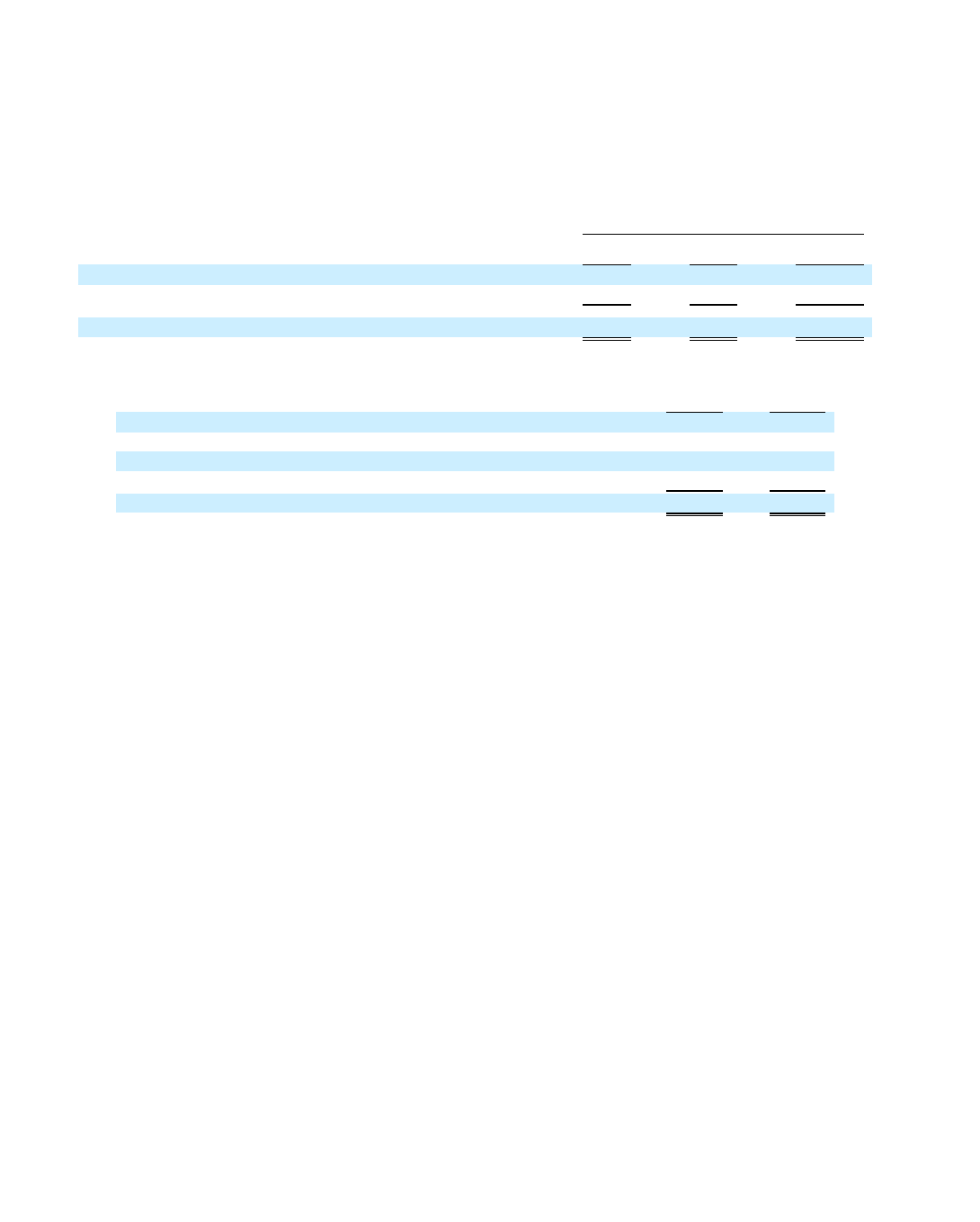

Realized gains and losses on available-for-sale securities comprise the following:

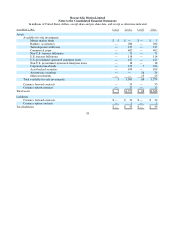

The contractual maturities of available-for-sale investments as at March 2, 2013 were as follows:

As at March 2, 2013 and March 3, 2012, the Company had no investments with continuous unrealized losses.

The Company engages in limited securities lending to generate fee income. Collateral, which exceeds the market value of the

loaned securities, is retained by the Company until the underlying security has been returned to the Company. As at March 2,

2013, the Company did not have any securities on loan (March 3, 2012 - nil).

During fiscal 2011, the Company recognized an other-than-temporary impairment charge on its auction rate securities in the

amount of $6 million as a result of the lack of continuing liquidity in these securities. In valuing these securities, the Company

used a multi-year investment horizon and considered the underlying risk of the securities and the current market interest rate

environment. The Company has the ability and intent to hold these securities until such time that market liquidity returns to

normal levels, and does not consider the principal or interest amounts on these securities to be materially at risk. The Company

has not recorded any additional impairment on its auction rate securities as of March 3, 2012 or March 2, 2013. As there is

uncertainty as to when market liquidity for auction rate securities will return to normal, the Company has classified the auction

rate securities as long-term investments on the consolidated balance sheet as at March 3, 2012 and March 2, 2013.

During fiscal 2011, the Company also recognized an other-than-temporary impairment charge of $11 million against a portion o

f

its claim on LBIE trust assets. These assets were represented by principal and interest payments from matured investments that

were originally held at LBIE at the time of bankruptcy. On October 30, 2012, the Company sold its claim on these assets at par

value, recovering the other-than-temporary impairment charge taken during fiscal 2011. The recovery is included within

investment income. This sale represented a significant transfer out of assets classified as Level 3 and is presented as such in

Note 5 to the financial statements.

13

For the year ended

March 2,

2013

March 3,

2012

February 26,

2011

Realized gains

$11 $ 1 $ 2

Realized losses

—

—

—

Net realized

g

ains

$11 $ 1 $ 2

Cost Basis Fair Valu

e

Due in one year or less $2,218 $2,219

Due in one to five

y

ears 134 134

Due after five

y

ears

35 36

No fixed maturit

y

date 5 5

$2,392 $2,394