Blackberry 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

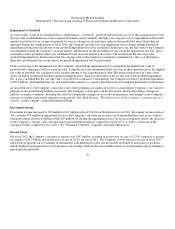

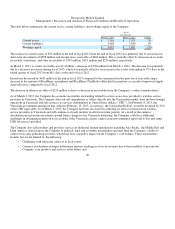

Service revenue decreased by $186 million, or 16.4%, to $947 million, or 35.4% of consolidated revenue, in the fourth quarter of

fiscal 2013, compared to $1.1 billion, or 27.1% of consolidated revenue, in the fourth quarter of fiscal 2012. The decrease in service

revenue reflects the Company’s net decrease in BlackBerry subscriber accounts since the fourth quarter of fiscal 2012, as well as a

decrease in ARPU. The decrease in ARPU resulted from recent pricing reduction programs implemented by the Company to maintain

the subscriber base as well as a shift in the mix of the Company’s subscriber base from higher tiered unlimited plans to prepaid and

lower tiered plans. The total BlackBerry subscriber base was approximately 76 million as at the end of the fourth quarter of fiscal

2013, reflecting a decrease of approximately 3 million subscriber accounts since the end of the third quarter of fiscal 2013. The

decrease in the subscriber accounts reflects decreases in the North America and EMEA regions, offset by increases in APAC and

LATAM in the fourth quarter of fiscal 2014. Please refer to the “Overview – Sources of Revenue” section for further discussion of

service revenue and the Company’s subscriber base.

Software revenue, which includes fees from licensed BES software, CALs, technical support, maintenance and upgrades decreased by

$17 million, or 21.3%, to $63 million, or 2.4% of consolidated revenue, in the fourth quarter of fiscal 2013, compared to $80 million,

or 1.9% of consolidated revenue, in the fourth quarter of fiscal 2012. This decrease was primarily attributable to a decrease in CALs

and maintenance revenue.

Other revenue, which includes non-warranty repairs, accessories, licensing revenues and gains and losses on revenue hedging

instruments, decreased by $74 million to $28 million in the fourth quarter of fiscal 2013 compared to $102 million in the fourth

quarter of fiscal 2012. The decrease was primarily attributable to losses on revenue hedging instruments as well as decreases in non-

warranty repair revenues and accessories. See “Market Risk of Financial Instruments – Foreign Exchange” for additional information

on the Company’s hedging instruments.

Gross Margin

Consolidated gross margin from continuing operations decreased by $325 million, or 23.2%, to $1.1 billion, or 40.1% of consolidated

revenue, in the fourth quarter of fiscal 2013, compared to $1.4 billion, or 33.4% of consolidated revenue, in the fourth quarter of fiscal

2012. Excluding the impact of charges related to the CORE program incurred in the fourth quarter of fiscal 2013, of which a recovery

of $4 million was attributable to cost of sales, as well as the impact of the PlayBook Inventory Provision and the BB7 Inventory

Provision incurred in the fourth quarter of fiscal 2012, gross margin decreased by $1.1 billion. Gross margin percentage in the fourth

quarter of fiscal 2013 reflects the higher average selling prices and gross margins of BlackBerry 10 devices shipped as well as cost

reductions generated by the CORE program.

The $1.1 billion decrease in consolidated gross margin was primarily attributable to the lower volume of BlackBerry handheld

devices shipped as a result of the Company’s aging product portfolio in a very competitive environment in which multiple

competitors introduced new devices beginning early in fiscal 2013 and the impact of allocating certain fixed costs, including licensing

costs, to lower shipment volumes. The decrease was partially offset by the higher average selling prices and gross margins of

BlackBerry 10 devices sold in the fourth quarter of fiscal 2013.

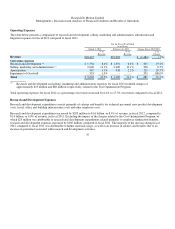

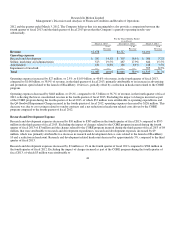

Operating Expenses

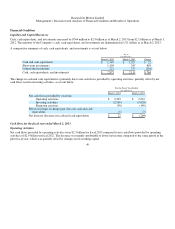

The table below presents a comparison of research and development, selling, marketing and administration, and amortization

expenses for the quarter ended March 2, 2013, compared to the quarter ended December 1,

43