Blackberry 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Sales outside the United States, the United Kingdom and Canada comprised approximately 60% of the total consolidated revenue

during fiscal 2012. Sales in the United States represented approximately 23% of total consolidated revenue during the year, a decrease

as a percentage of total consolidated revenue compared to the prior year resulting from factors described above, shifts in the

competitive dynamics within the United States, an increase of in-life products that makes up the Company’s product mix, as well as

growth in international markets compared to fiscal 2011. Sales in the United Kingdom represented approximately 10% of total

consolidated revenue and sales in Canada represented the remainder. During fiscal 2012, the Company experienced a significant

decrease in its share of the smartphone market in the United States compared to fiscal 2011. Intense competition, the lack of an LTE

product and a high-end consumer offering in the United States is negatively impacting the Company’s results in that market. The

Company has also encountered challenges due to the impact of BYOD strategies being adopted by some of its enterprise customers,

as some IT departments that previously required employees to use the BlackBerry wireless solution because of its emphasis on

security and reliability are permitting employees to choose devices offered by the Company’s competitors.

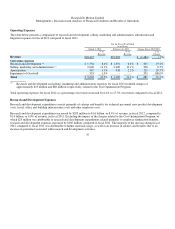

Gross Margin

Consolidated gross margin from continuing operations decreased by $2.2 billion, or approximately 25.5%, to $6.6 billion, or 35.7% o

f

consolidated revenue, in fiscal 2012, compared to $8.8 billion, or 44.3% of consolidated revenue, in fiscal 2011.

During the fourth quarter of fiscal 2012, the Company recorded the Q4 BlackBerry Inventory Provision consisting of pre-tax charges

of approximately $267 million, or approximately $197 million after-tax, relating primarily to certain BlackBerry 7 products with its

current portfolio of hardware devices. The non-cash charges represent the Company’s estimates of provisions required to sell through

existing inventory in the channel based on estimated inventory levels of certain BlackBerry 7 products, as well as related vendor

liabilities as of March 3, 2012. The Company also experienced a decrease in its forward-looking demand relating to certain

BlackBerry 7 products and as such, recorded a reduction in the carrying value of its inventory, and increased its estimate of the excess

inventory and contractual liabilities with its manufacturing partners for units or materials relating to those products.

Excluding the impact of the charges related to the Q4 BlackBerry 7 Inventory Provision, the Cost Optimization Program, the

PlayBook Inventory Provision and the charges related to the Q3 Service Interruption, consolidated gross margin decreased by $1.4

billion compared to fiscal 2011. The decline in consolidated gross margin percentage was primarily attributable to the decreased

number of BlackBerry handheld device shipments in fiscal 2012 compared to fiscal 2011, as well as the mix of BlackBerry handheld

devices sold during fiscal 2012, which were weighted towards in-life products with lower average selling prices and gross margins.

The impact of the BlackBerry PlayBook sell-through programs conducted during the third and fourth quarters of fiscal 2012 further

contributed to the year-over-year decline in the consolidated gross margin. The overall decline was partially offset by an increase in

service revenue as a result of additional subscriber accounts, which comprised 22.1% of the total revenue mix for fiscal 2012

compared to 16.1% in fiscal 2011. Gross margin percentage for BlackBerry handheld devices and BlackBerry PlayBook tablets are

generally lower than the Company’s consolidated gross margin percentage.

36