Blackberry 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

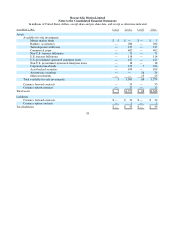

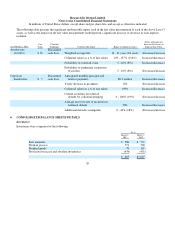

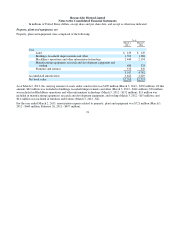

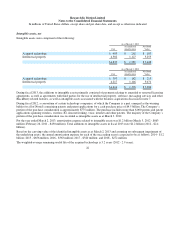

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

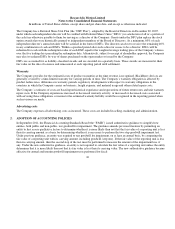

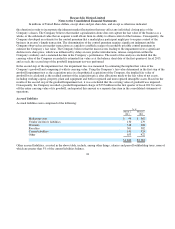

The Company corroborates the fair values provided by the independent third party for corporate notes/bonds (other than those

classified as Level 3) by comparing those provided against fair values determined by the Company utilizing quoted prices from

vendors for identical securities, or the market prices of similar securities adjusted for observable inputs such as differences in

maturity dates, interest rates, yield curves, swap rates, credit ratings, industry comparable trades and spread history. The

corporate notes/bonds held by the Company are all issued by major corporate organizations and have investment grade ratings.

The Company corroborates the fair values provided by the independent third party for asset-backed securities by comparing

those provided against fair values determined by the Company utilizing quoted prices from vendors for identical securities, or

the market prices of similar securities adjusted for observable inputs such as differences in swap rates and spreads, credit ratings,

pricing changes relative to asset class, priority in capital structure, principal payment windows, and maturity dates. All asset-

backed securities held by the Company are issued by government or consumer agencies and are primarily backed by commercial

automobile and equipment loans and leases. All asset-backed securities held by the Company have investment grade ratings.

Fair values for all investment categories provided by the independent third party that are in excess of 0.5% from the fair values

determined by the Company are communicated to the third party for consideration of reasonableness. The independent third

party considers the information provided by the Company before determining whether a change in the original pricing is

warranted.

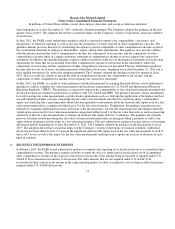

The fair values of corporate notes/bonds classified as Level 3, which represent investments in securities for which there is not an

active market, are estimated using a discounted cash flow pricing methodology incorporating unobservable inputs such as

anticipated monthly interest and principal payments received, existing and estimated defaults, and collateral value. The

corporate notes/bonds classified as Level 3 held by the Company consist of securities received in a payment-in-kind distribution

from a former structured investment vehicle.

The fair value of auction rate securities is estimated using a discounted cash flow model incorporating estimated weighted-

average lives based on contractual terms, assumptions concerning liquidity, and credit adjustments of the security sponsor to

determine timing and amount of future cash flows. Some of these inputs are unobservable.

The fair values of currency forward contracts and currency option contracts have been determined using notional and exercise

values, transaction rates, market quoted currency spot rates, forward points and interest rate yield curves. For currency forward

contracts and currency option contracts, the estimates presented herein are not necessarily indicative of the amounts that the

Company could realize in a current market exchange. Changes in assumptions could have a significant effect on the estimates.

16