Blackberry 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

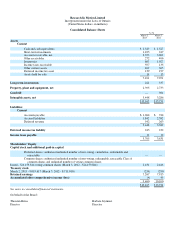

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

Foreign currency translation

The U.S. dollar is the functional and reporting currency of the Company. Foreign currency denominated assets and liabilities of

the Company and all of its subsidiaries are translated into U.S. dollars. Accordingly, monetary assets and liabilities are translated

using the exchange rates in effect at the consolidated balance sheet dates and revenues and expenses are translated at the rates of

exchange prevailing when the transactions occurred. Remeasurement adjustments are included in income. Non-monetary assets

and liabilities are translated at historical exchange rates.

Cash and cash equivalents

Cash and cash equivalents consist of balances with banks and liquid investments with maturities of three months or less at the

date of acquisition.

Accounts receivable, net

The accounts receivable balance which reflects invoiced and accrued revenue is presented net of an allowance for doubtful

accounts. The allowance for doubtful accounts reflects estimates of probable losses in accounts receivables. The Company is

dependent on a number of significant customers and on large complex contracts with respect to sales of the majority of its

products, software and services. The Company expects the majority of its accounts receivable balances to continue to come from

large customers as it sells the majority of its devices and software products and service relay access through network carriers and

resellers rather than directly.

The Company evaluates the collectability of its accounts receivables based upon a combination of factors on a periodic basis

such as specific credit risk of its customers, historical trends and economic circumstances. The Company, in the normal course

of business, monitors the financial condition of its customers and reviews the credit history of each new customer. When the

Company becomes aware of a specific customer’s inability to meet its financial obligations to the Company (such as in the case

of bankruptcy filings or material deterioration in the customer’s operating results or financial position, and payment

experiences), the Company records a specific bad debt provision to reduce the customer’s related accounts receivable to its

estimated net realizable value. If circumstances related to specific customers change, the Company’s estimates of the

recoverability of accounts receivables balances could be further adjusted. The allowance for doubtful accounts as at March 2,

2013 is $17 million (March 3, 2012 - $16 million).

While the Company sells its products and services to a variety of customers, there were no customers that comprised more than

10% of the Company’s revenue in fiscal 2013 (March 3, 2012 – no customers that comprised more than 10%; February 26, 2011

– two customers comprised 11% each). There was one customer that comprised 8.2% of accounts receivable as at March 2, 2013

(March 3, 2012 – one customer comprised 13%).

Investments

The Company’s cash equivalents and investments, other than cost method investments of $4 million (March 3, 2012 - $37

million) and equity method investments of $46 million (March 3, 2012 - $48 million), consist of money market and other debt

securities, which are classified as available-for-sale for accounting purposes and are carried at fair value with unrealized gains

and losses net of related income taxes recorded in accumulated other comprehensive income until such investments mature or

are sold. The Company uses the specific identification method of determining the cost basis in computing realized gains or

losses on available-for-sale investments

2