Blackberry 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

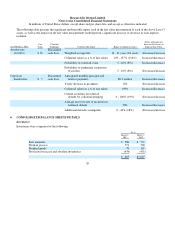

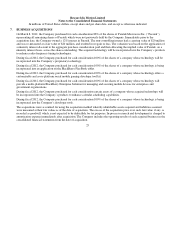

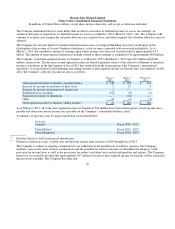

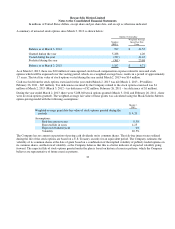

this duration in order to incorporate the inherent market fluctuations that may affect any individual closing price of the

Company’s shares. The Company believes that market capitalization alone does not capture the fair value of the business as a

whole, or the substantial value that an acquirer would obtain from its ability to obtain control of the business. Consequently, the

Company developed an estimate for the control premium that a marketplace participant might pay to acquire control of the

business in an arm’s-length transaction. The determination of the control premium requires significant judgment and the

Company observed recent market transactions as a guide to establish a range of reasonably possible control premiums to

estimate the Company’s fair value. The Company believes that the main factors leading to the impairment were a significant

decline in its share price, which was influenced by delays in new product introductions, intense competition within the

Company’s industry and a sustained decline in the Company’s performance. The result of this analysis concluded that the

carrying value of the Company exceeded its estimated fair value as at the balance sheet date of the first quarter of fiscal 2013,

and as such, the second step of the goodwill impairment test was performed.

In the second step of the impairment test, the impairment loss was measured by estimating the implied fair value of the

Company’s goodwill and comparing it with its carrying value. Using the Company’s fair value determined in the first step of the

goodwill impairment test as the acquisition price in a hypothetical acquisition of the Company, the implied fair value of

goodwill was calculated as the residual amount of the acquisition price after allocations made to the fair value of net assets,

including working capital, property, plant and equipment and both recognized and unrecognized intangible assets. Based on the

results of the second step of the goodwill impairment test, it was concluded that the carrying value of goodwill was impaired.

Consequently, the Company recorded a goodwill impairment charge of $335 million in the first quarter of fiscal 2013 to write-

off the entire carrying value of its goodwill, and reported this amount as a separate line item in the consolidated statements of

operations.

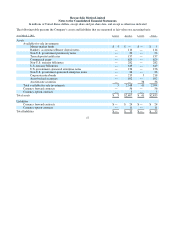

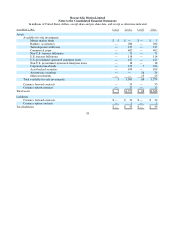

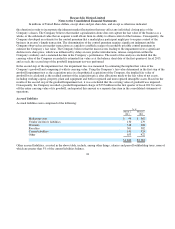

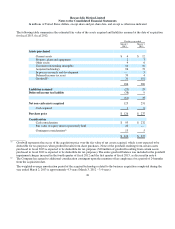

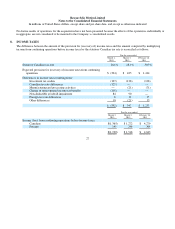

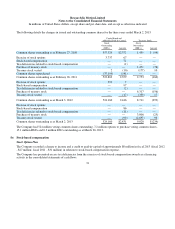

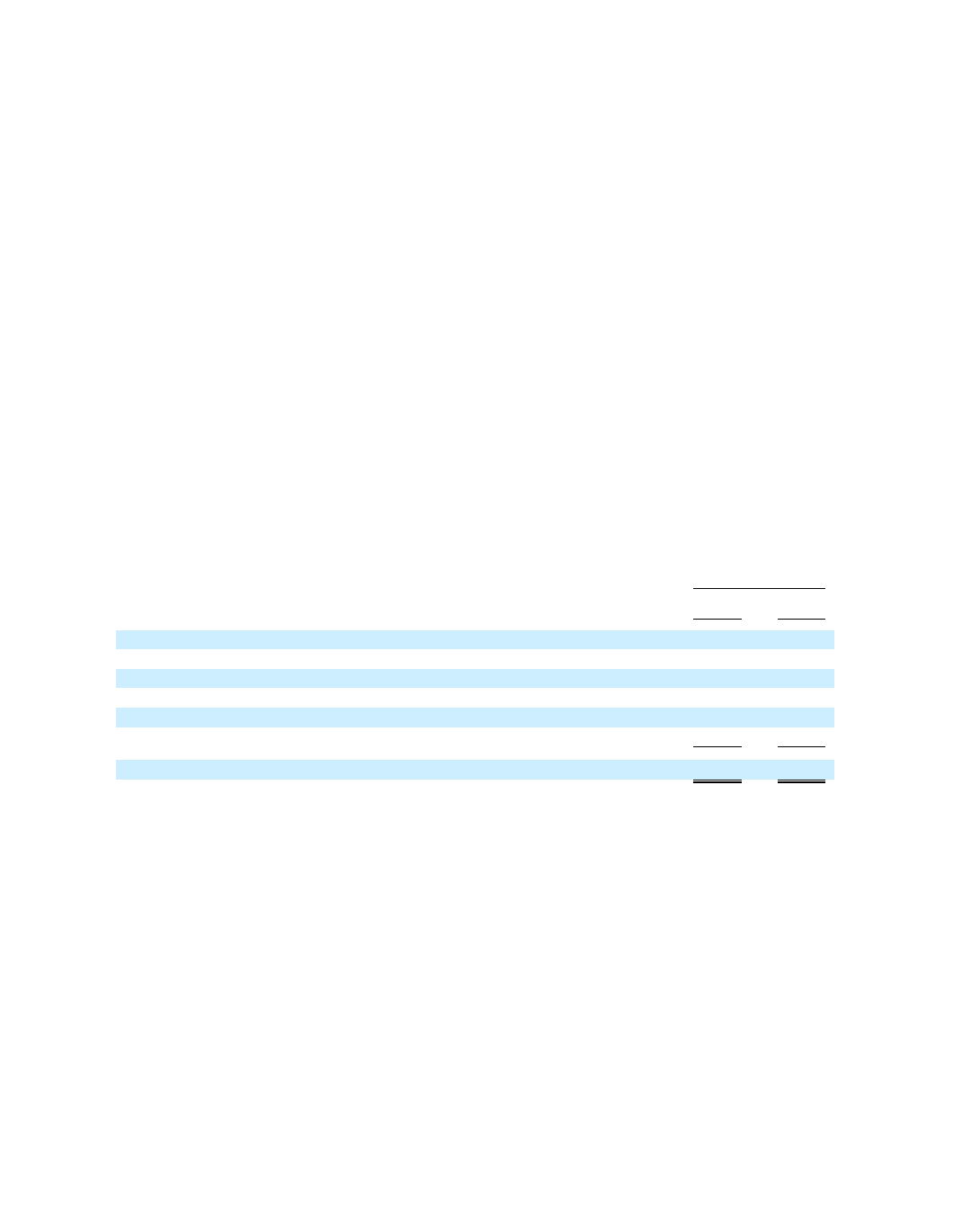

Accrued liabilities

Accrued liabilities were comprised of the following:

Other accrued liabilities, as noted in the above table, include, among other things, salaries and payroll withholding taxes, none o

f

which are greater than 5% of the current liabilities balance.

24

As at

March 2,

2013

March 3,

2012

Marketin

g

costs

$99 $367

Vendor inventor

y

liabilities 130 279

Warrant

y

318 408

Ro

y

alties

501 382

Carrier liabilities

141 524

Other

653 422

$1,842 $2,382