Blackberry 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

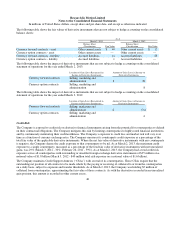

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

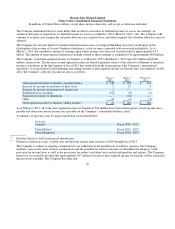

The Company is involved in litigation in the normal course of its business, both as a defendant and as a plaintiff. The Company

is subject to a variety of claims (including claims related to patent infringement, purported class actions and other claims in the

normal course of business) and may be subject to additional claims either directly or through indemnities against claims that it

provides to certain of its partners and customers. In particular, the industry in which the Company competes has many

participants that own, or claim to own, intellectual property, including participants that have been issued patents and may have

filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those used by the

Company in its products. The Company has received, and may receive in the future, assertions and claims from third parties that

the Company’s products infringe on their patents or other intellectual property rights. Litigation has been and will likely

continue to be necessary to determine the scope, enforceability and validity of third-party proprietary rights or to establish the

Company’s proprietary rights. Regardless of whether claims against the Company have merit, those claims could be time-

consuming to evaluate and defend, result in costly litigation, divert management’s attention and resources, subject the Company

to significant liabilities and could have the other effects that are described in greater detail under “Risk Factors – Risks Related

to Intellectual Property” and “Risk Factors - Risks Related to the Company’s Business and its Industry - The Company is subject

to general commercial litigation, class action and other litigation claims as part of its operations, and it could suffer significant

litigation expenses in defending these claims and could be subject to significant damage awards or other remedies” in the

Company’s unaudited Annual Information Form for the fiscal year ended March 3, 2013, which is included in the Company’s

Annual Report on Form 40-F.

Management reviews all of the relevant facts for each claim and applies judgment in evaluating the likelihood and, if applicable,

the amount of any potential loss. Where it is considered probable for a material exposure to result and where the amount of the

claim is quantifiable, provisions for loss are made based on management’s assessment of the likely outcome. The Company does

not provide for claims that are considered unlikely to result in a significant loss, claims for which the outcome is not

determinable or claims where the amount of the loss cannot be reasonably estimated. Any settlements or awards under such

claims are provided for when reasonably determinable.

Additional lawsuits and claims, including purported class actions and derivative actions, may be filed or made based upon the

Company’s historical stock option granting practices. Management assesses such claims and where considered likely to result in

a material exposure and, where the amount of the claim is quantifiable, provisions for loss are made based on management’s

assessment of the likely outcome. The Company does not provide for claims that are considered unlikely to result in a significant

loss, claims for which the outcome is not determinable or claims where the amount of the loss cannot be reasonably estimated.

Any settlements or awards under such claims are provided for when reasonably determinable.

See the “Legal Proceedings and Regulatory Action” section of the Company’s unaudited Annual Information Form for

additional unaudited information regarding the Company’s legal proceedings, which is included in the Company’s Annual

Report on Form 40-F and “Legal Proceedings” in the unaudited Management’s Discussion and Analysis of financial condition

and results of operations for fiscal 2013.

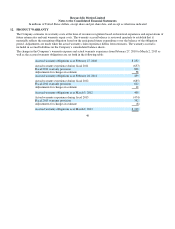

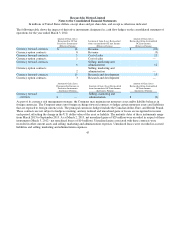

The Company attempts to ensure that most components essential to the Company’s business are generally available from

multiple sources, however certain components are currently obtained from limited sources within a competitive market which

subjects the Company to significant supply, availability and pricing risks. Many components are at times subject to industry-

wide shortages and significant commodity pricing fluctuations

36

(c) Litigation

(d) Concentrations in certain areas of the Company’s business