Blackberry 2013 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

enterprise market is currently characterized by a combination of enterprise-deployed devices and devices that are purchased by

consumers but also used in the corporate environment, commonly referred to as “Bring Your Own Device” (“BYOD”). The Company

has encountered challenges adapting to the BYOD movement as some information technology (“IT”) departments that previously

required employees to use the BlackBerry wireless solution because of its emphasis on security and reliability are permitting

employees to choose devices offered by the Company’s competitors, who are increasingly promoting the merits of their own security

and reliability, and this has impacted the Company’s enterprise subscriber account base. To address this evolution of the market, the

Company has introduced products including its first BlackBerry 10 smartphones with BlackBerry Balance and BlackBerry Enterprise

Service 10, which give IT departments the ability to securely manage BlackBerry devices and other operating system platforms

through a single unified interface and to securely protect corporate data on an employee’s personal smartphone or tablet. The

Company expects that with the introduction of BlackBerry 10 smartphones, which began in certain markets in the fourth quarter of

fiscal 2013 and will continue in the first quarter of fiscal 2014, its position in the BYOD enterprise market will strengthen and the

Company will also continue to seek partnerships that will further enable the Company to have a complete BYOD offering.

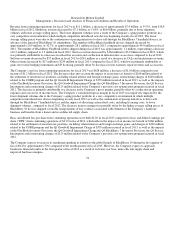

BlackBerry is the leading smartphone in several markets around the world. The primary regions experiencing recent growth for the

Company include Asia Pacific and Latin America. The Company has experienced a decline in revenue and market share, particularly

in the United States. Intense competition is negatively impacting the Company’s results in that market, as did the lack of a Long Term

Evolution (“LTE”) product and high-end consumer offering prior to the launch of the first BlackBerry 10 smartphone in the United

States on March 22, 2013. The decline can also be attributed to consumer preferences for devices with access to the broadest number

of applications, such as those available in the iOS and Android environments. Market share has also been impacted by the significant

number of new Android-based competitors that have entered the market. In addition, the increased desire by carriers to sell devices

that operate on the new, faster LTE networks being built has also impacted the Company’s market share, as these networks feature

faster download speeds and allow carriers to offer higher-value data plans. The Company’s first LTE smartphones were launched

with the introduction of the Company’s first BlackBerry 10 smartphones in certain markets in the fourth quarter of fiscal 2013 and in

the United States on March 22, 2013. Some of the Company’s main competitors include Apple Inc., Google Inc., Samsung

Electronics Co., Ltd, HTC Corporation, Huawei Technologies Co., Ltd, Microsoft Corporation, Nokia Corporation and ZTE

Corporation.

BlackBerry World, the Company’s comprehensive electronic content distribution catalogue, is available to customers in over 100

markets globally, with other markets to follow. The continued expansion of the catalogue of applications and other content is an

important element of the Company’s successful transition to its next-generation BlackBerry 10 smartphones and the success of the

BlackBerry PlayBook tablet, and requires a substantial investment of internal resources for development of the infrastructure,

improvement of developer and consumer interfaces and advertising costs. There are over 100,000 applications available for

BlackBerry 10 smartphones and over 200,000 applications in total available through BlackBerry World.

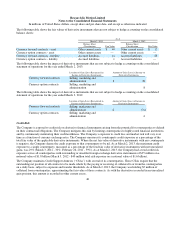

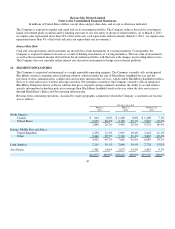

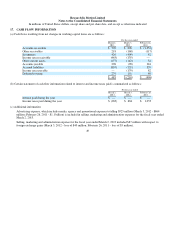

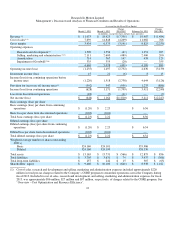

The Company currently has a strong balance sheet with negligible debt and approximately $2.9 billion in cash, cash equivalents and

investments as of March 2, 2013. In fiscal 2013, the Company had annual sales of $11.1 billion and the Company incurred a net loss

from continuing operations of $628 million, or $1.20 per share diluted.

The Company made a number of strategic acquisitions in recent years including QNX Software Systems (“QNX”), Certicom, Torch

Mobile, The Astonishing Tribe, Gist and Tungle that are intended to accelerate the

5