Blackberry 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

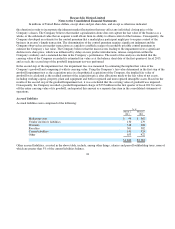

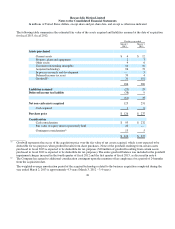

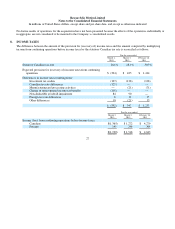

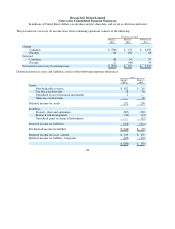

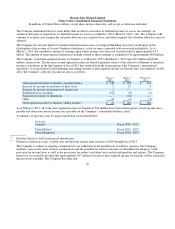

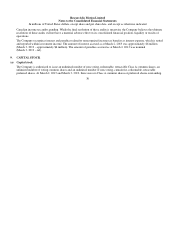

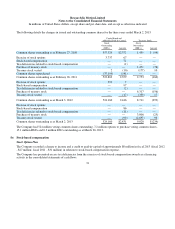

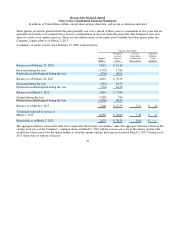

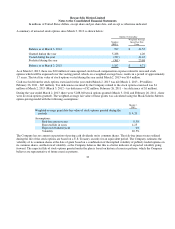

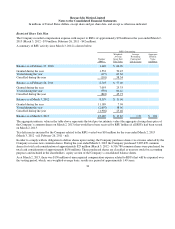

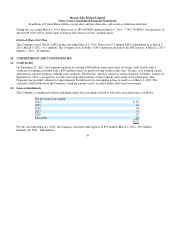

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

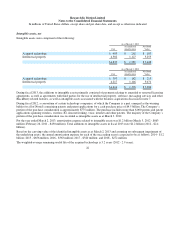

On March 8, 2012, the Company purchased for cash consideration 88% of the shares of Paratek Microwave Inc. (“Paratek”),

representing all remaining shares of Paratek which were not previously held by the Company. Immediately prior to the

acquisition date, the Company owned a 12% interest in Paratek. The non-controlling interest had a carrying value of $20 million

and was re-measured at a fair value of $20 million, and resulted in no gain or loss. The valuation was based on the application of

a minority interest discount to the aggregate purchase consideration paid and then allocating the implied value of Paratek, on a

minority interest basis, across the shares outstanding. The acquired technology will be incorporated into the Company’s products

to enhance radio frequency tuning technologies.

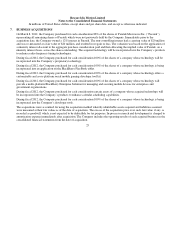

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology will be

incorporated into the Company’s proprietary technology.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology is being

incorporated into an application on the BlackBerry PlayBook tablet.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology offers a

customizable and cross-platform social mobile gaming developer tool kit.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology will

provide a multi-platform BlackBerry Enterprise Solution for managing and securing mobile devices for enterprises and

government organizations.

During fiscal 2012, the Company purchased for cash consideration certain assets of a company whose acquired technology will

be incorporated into the Company’s products to enhance calendar scheduling capabilities.

During fiscal 2012, the Company purchased for cash consideration 100% of the shares of a company whose technology is being

incorporated into the Company’s developer tools.

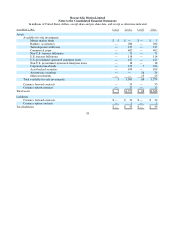

The acquisitions were accounted for using the acquisition method whereby identifiable assets acquired and liabilities assumed

were measured at their fair values as of the date of acquisition. The excess of the acquisition price over such fair value, if any, is

recorded as goodwill, which is not expected to be deductible for tax purposes. In-process research and development is charged to

amortization expense immediately after acquisition. The Company includes the operating results of each acquired business in the

consolidated financial statements from the date of acquisition.

25

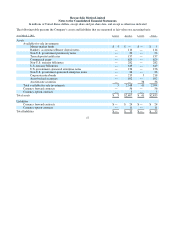

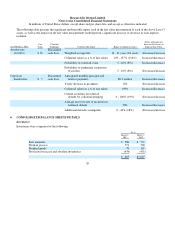

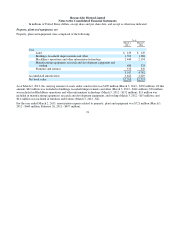

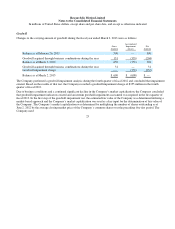

7. BUSINESS ACQUISITIONS