Blackberry 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

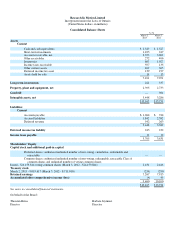

Research In Motion Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

which are recorded in investment income. In the event of a decline in value which is other-than-temporary, the investment is

written down to fair value with a charge to income. The Company does not exercise significant influence with respect to any of

these investments.

Investments with maturities of one year or less, as well as any investments that management intends to hold for less than one

year, are classified as short-term investments. Investments with maturities in excess of one year are classified as long-term

investments.

The Company assesses individual investments that are in an unrealized loss position to determine whether the unrealized loss is

other-than-temporary. The Company makes this assessment by considering available evidence, including changes in general

market conditions, specific industry and individual company data, the length of time and the extent to which the fair value has

been less than cost, the financial condition, the near-term prospects of the individual investment and the Company’s intent and

ability to hold the investment. In the event that a decline in the fair value of an investment occurs and the decline in value is

considered to be other-than-temporary, an impairment charge is recorded in investment income equal to the difference between

the cost basis and the fair value of the individual investment at the consolidated balance sheet date of the reporting period for

which the assessment was made. The fair value of the investment then becomes the new cost basis of the investment.

If a debt security’s market value is below its amortized cost and the Company either intends to sell the security or it is more

likely than not that the Company will be required to sell the security before its anticipated recovery, the Company records an

other-than-temporary impairment charge to investment income for the entire amount of the impairment. For other-than-

temporary impairments on debt securities that the Company does not intend to sell and it is not more likely than not that the

entity will be required to sell the security before its anticipated recovery, the Company would separate the other-than-temporary

impairment into the amount representing the credit loss and the amount related to all other factors. The Company would record

the other-than-temporary impairment related to the credit loss as a charge to investment income and the remaining other-than-

temporary impairment would be recorded as a component of accumulated other comprehensive income.

Derivative financial instruments

The Company uses derivative financial instruments, including forward contracts and options, to hedge certain foreign currency

exposures. The Company does not use derivative financial instruments for speculative purposes.

The Company records all derivative instruments at fair value on the consolidated balance sheets. The fair value of these

instruments is calculated based on notional and exercise values, transaction rates, market quoted currency spot rates, forward

points and interest rate yield curves. The accounting for changes in the fair value of a derivative depends on the intended use of

the derivative instrument and the resulting designation.

For derivative instruments designated as cash flow hedges, the effective portion of the derivative’s gain or loss is initially

reported as a component of accumulated other comprehensive income, net of tax, and subsequently reclassified into income in

the same period or periods in which the hedged item affects income. The ineffective portion of the derivative’s gain or loss is

recognized in current income. In order for the Company to receive hedge accounting treatment, the cash flow hedge must be

highly effective in offsetting changes in the fair value of the hedged item and the relationship between the hedging instrument

and the associated hedged item must be formally documented at the inception of the hedge relationship. Hedge effectiveness is

formally assessed, both at hedge inception and on an ongoing basis, to determine whether the derivatives used in hedging

transactions are highly effective in offsetting changes in the value of the hedged items and whether they are expected to continue

to be highly effective in future periods.

3