Blackberry 2013 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

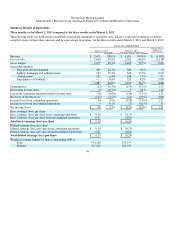

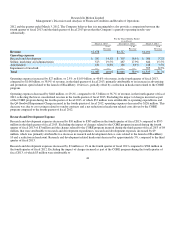

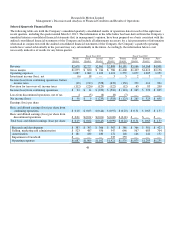

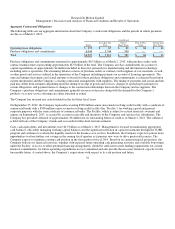

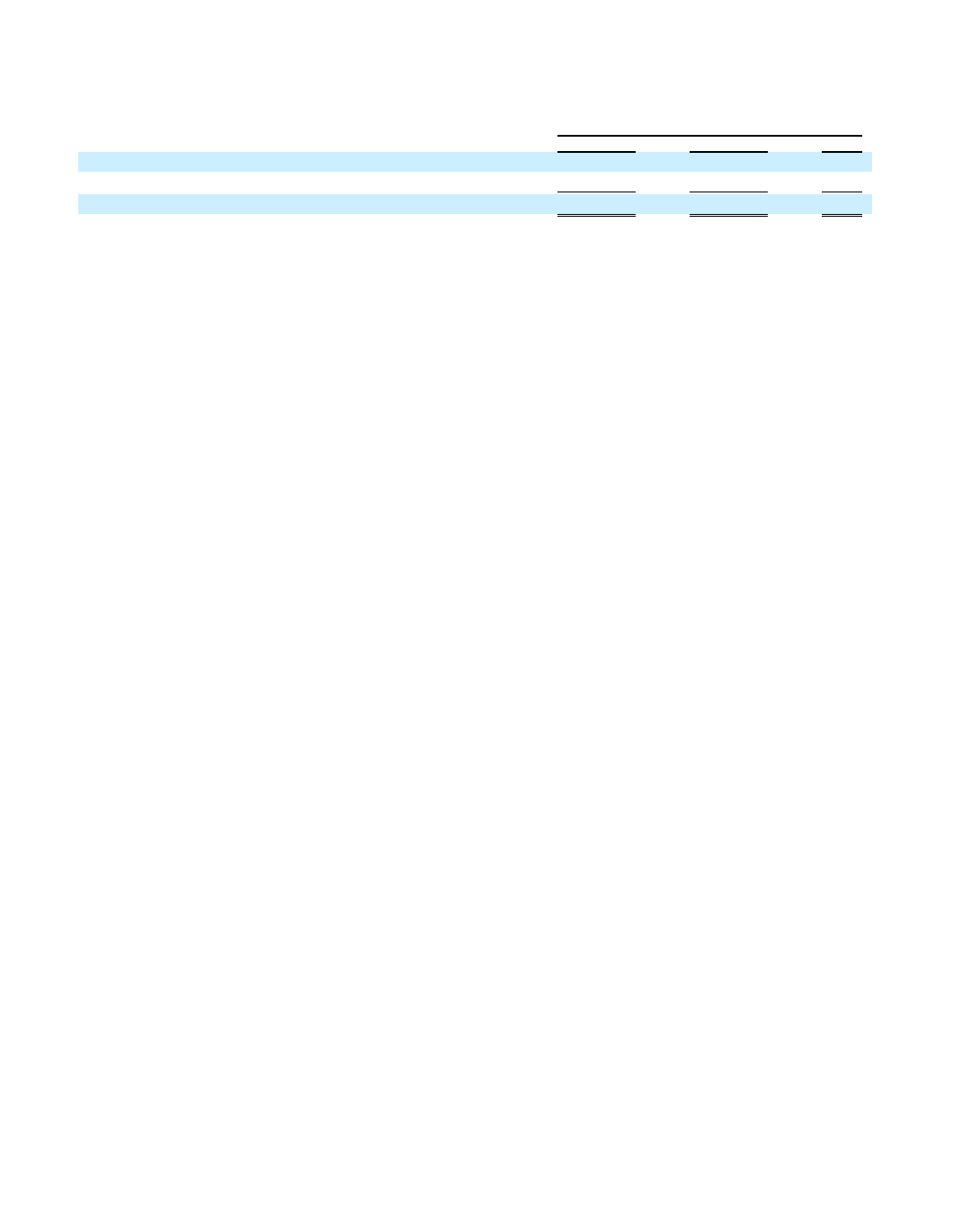

The table below summarizes the current assets, current liabilities, and working capital of the Company:

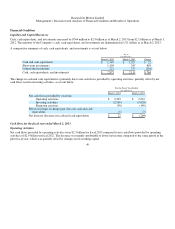

The increase in current assets of $30 million at the end of fiscal 2013 from the end of fiscal 2012 was primarily due to an increase in

short-term investments of $858 million and income taxes receivable of $462 million. This is partially offset by decreases in accounts

receivable, inventories, and other receivables of $709 million, $424 million and $224 million, respectively.

At March 2, 2013, accounts receivable was $2.4 billion, a decrease of $709 million from March 3, 2012. The decrease was primarily

due to a decrease in revenue during fiscal 2013, which was partially offset by an increase in days sales outstanding to 79.9 days in the

fourth quarter of fiscal 2013 from 68.1 days at the end of fiscal 2012.

Inventories decreased by $424 million at the end of fiscal 2013 compared to the same period in the prior fiscal year, reflecting a

decrease in the amount of BlackBerry smartphone and BlackBerry PlayBook tablets held in inventory as a result of improved supply

chain efficiency compared to fiscal 2012.

The decrease in other receivables of $224 million is due to a decrease in receivables from the Company’s contract manufacturers.

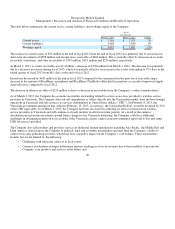

As of March 2, 2013, the Company has accounts receivables outstanding related to service access fees provided to wireless service

providers in Venezuela. The Company does not sell smartphones or tablets directly into the Venezuelan market, does not have foreign

operations in Venezuela and only invoices its services denominated in United States dollars (“USD”). On February 8, 2013, the

Venezuela government announced that, effective February 13, 2013, its currency, the Venezuelan Bolivar, would be devalued by 32%

of the USD equivalent. As of March 2, 2013, the Company has been successful in collecting its service revenues from wireless

service providers in Venezuela and will continue to closely monitor its efforts in future periods. As a result of the currency

devaluation and given the uncertainty around future changes to the Venezuela leadership, the Company could face additional

challenges in obtaining payment on its receivables if the Venezuela carriers cannot secure governmental approvals to buy and remit

USD for services provided.

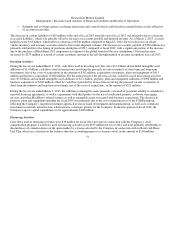

The Company also sells products and provides services in additional foreign jurisdictions including Asia-Pacific, the Middle East and

Latin America, which expose the Company to political, legal and economic uncertainties and may limit the Company’s ability to

collect on its sales generating activities, which may have a negative impact on the Company’s cash balance. These uncertainties

include, but are not limited to, the following:

50

As at

(in millions)

March 2, 2013 March 3, 2012 Change

Current assets

$7,101 $7,071 3

0

Current liabilities

3,448 3,389 59

Workin

g

ca

p

ital

$3,653 $3,682 (29)

• Challen

g

es with enforcin

g

contracts in local courts;

• Currency devaluations in hyper-inflationary markets resulting in a loss of revenues due to their inability to procure the

Com

p

an

y

’s our

p

roducts and services in the future; and