Blackberry 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

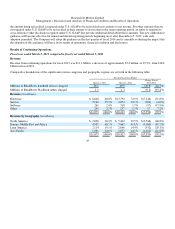

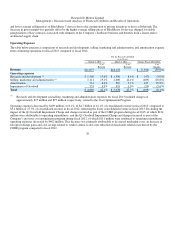

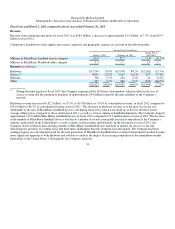

Software revenue, which includes fees from licensed BES software, CALs, technical support, maintenance and upgrades decreased by

$57 million, or 17.9%, to $261 million, or 2.4% of consolidated revenue, in fiscal 2013, compared to $318 million, or 1.7% of

consolidated revenue, in fiscal 2012. This decrease was primarily attributable to a decrease in CALs and maintenance revenue.

Other revenue, which includes non-warranty repairs, accessories, licensing revenues and gains and losses on revenue hedging

instruments, increased by $17 million to $254 million in fiscal 2013 compared to $237 million in fiscal 2012. The majority of the

increase was attributable to increases in gains on revenue hedging instruments and IP licensing, partially offset by decreases in non-

warranty repair revenues and accessories revenue. See “Market Risk of Financial Instruments - Foreign Exchange” for additional

information on the Company’s hedging instruments.

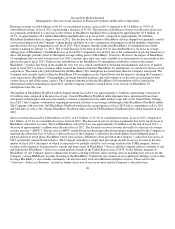

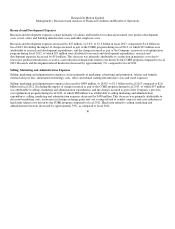

The Company has encountered challenges adapting to the BYOD movement as some IT departments that previously required

employees to use the BlackBerry wireless solution because of its emphasis on security and reliability are permitting employees to

choose devices offered by the Company’s competitors who are increasingly promoting the merits of their own security and reliability,

and this has impacted the Company’s enterprise subscriber account base. To address this evolution of the market, the Company has

introduced products including its first BlackBerry 10 smartphones with BlackBerry Balance and BlackBerry Enterprise Service 10,

which give IT departments the ability to securely manage BlackBerry devices and other operating system platforms through a single

unified interface and to securely protect corporate data on an employee’s personal smartphone or tablet. The Company expects that

with the introduction of BlackBerry 10 smartphones, which began in certain markets in the fourth quarter of fiscal 2013 and will

continue in the first quarter of fiscal 2014, its position in the BYOD enterprise market will strengthen and the Company will also

continue to seek partnerships that will further enable the Company to have a complete BYOD offering.

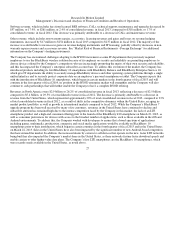

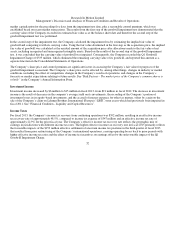

Revenues in North America were $2.9 billion or 26.2% of consolidated revenue in fiscal 2013, reflecting a decrease of $2.5 billion

compared to $5.4 billion, or 29.5% of consolidated revenue in fiscal 2012. The decrease is primarily attributable to a decrease in

revenue from the United States, which represented approximately 20% of total consolidated revenue in fiscal 2013, compared to 23%

of total consolidated revenue in fiscal 2012, as a result of shifts in the competitive dynamics within the United States, an aging in-

market product portfolio, as well as growth in international markets compared to fiscal 2012. While the Company’s BlackBerry 7

upgrade program has been well received by many of its customers, revenues in the United States have continued to decline and

subscriber attrition has remained high due to the intense competition faced by the Company in this market, the lack of an LTE

smartphone product and a high-end consumer offering prior to the launch of the BlackBerry Z10 smartphone on March 22, 2013, as

well as consumer preferences for devices with access to the broadest number of applications, such as those available in the iOS and

Android environments. To address this, the Company worked with developers to ensure that a broad spectrum of applications

including games, multimedia, productivity, enterprise and social media applications would be available on BlackBerry 10

smartphones prior to their introduction, which began in certain countries in the fourth quarter of fiscal 2013 and in the United States

on March 22, 2013. Sales in the United States have also been impacted by the significant number of new Android-based competitors

that have entered the market. In addition, the increased desire by carriers to sell devices that operate on the new, faster LTE networks

being built has also impacted the Company’s market share in the United States, as these networks feature faster download speeds and

enable carriers to offer higher-value data plans. The Company’s first LTE smartphones are the BlackBerry 10 smartphones, which

were recently made available in the United States, as noted above.

27