Blackberry 2013 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

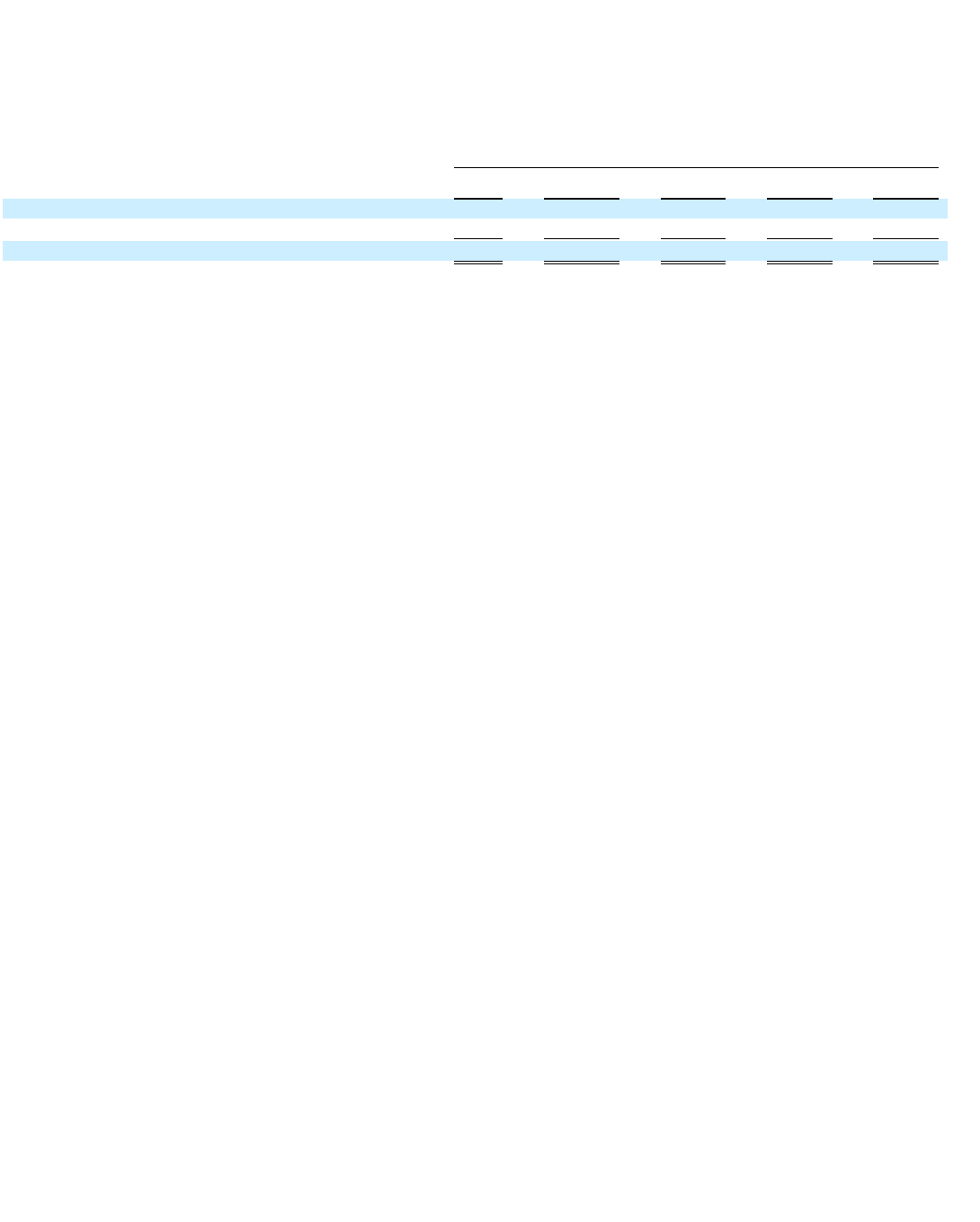

A

ggregate Contractual Obligations

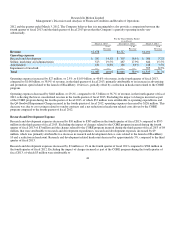

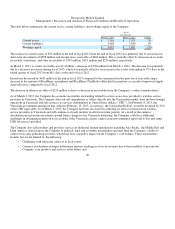

The following table sets out aggregate information about the Company’s contractual obligations and the periods in which payments

are due as at March 2, 2013:

Purchase obligations and commitments amounted to approximately $6.3 billion as at March 2, 2013, with purchase orders with

contract manufacturers representing approximately $4.9 billion of the total. The Company also has commitments on account of

capital expenditures of approximately $4 million included in this total, primarily for manufacturing and information technology,

including service operations. The remaining balance consists of purchase orders or contracts with suppliers of raw materials, as well

as other goods and services utilized in the operations of the Company including payments on account of licensing agreements. The

expected timing of payments and actual amounts to be paid for these purchase obligations and commitments is estimated based upon

current information and the Company’s existing contractual arrangements with suppliers. The timing of payments and actual amounts

paid may differ from estimates depending upon the timing of receipt of goods and services, changes to agreed-upon amounts for

certain obligations, and payment terms or changes to the contractual relationships between the Company and its suppliers. The

Company’s purchase obligations and commitments generally increase or decrease along with the demand for the Company’s

products, or as new service offerings are either launched or exited.

The Company has not paid any cash dividends in the last three fiscal years.

On September 25, 2012, the Company replaced its existing $500 million senior unsecured revolving credit facility with a syndicate of

commercial banks with a $500 million senior secured revolving credit facility (the “Facility”) for working capital and general

corporate purposes with the same syndicate of commercial banks. The Facility, which is subject to certain financial covenants and

expires on September 6, 2013, is secured by accounts receivable and inventory of the Company and certain of its subsidiaries. The

Company has provided collateral of approximately $6 million for its outstanding letters of credit as of March 2, 2013. The collateral

is held with one of the Company’s banks and is recorded within short-term investments.

Cash, cash equivalents, and investments were $2.9 billion as at March 2, 2013. Management is focused on maintaining appropriate

cash balances, efficiently managing working capital balances and the significant reduction in capital investments through the CORE

program and continues to evaluate the liquidity needs for the business as it evolves. In addition, the Company expects to pursue more

opportunities to attain further cost savings in the coming fiscal quarters as it pursues new ways to drive greater efficiencies. The

Company expects to maintain a strong cash position in the first quarter of fiscal 2014. Based on its current financial projections, the

Company believes its financial resources, together with expected future operating cash generating activities and available borrowings

under the Facility, or access to other potential financing arrangements, should be sufficient to meet funding requirements for current

financial commitments, for future operating expenditures not yet committed and also provide the necessary financial capacity for the

foreseeable future. As noted above, the Company’s expectations with respect to its cash position and future

52

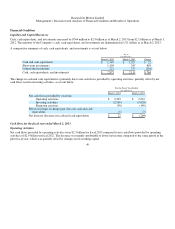

(in millions)

Total

Less than One

Year

One to

Three Years

Four to Five

Years

Greater than

Five Years

Operating lease obligations

$253 $67 $ 8

0

$ 6

0

$46

Purchase obli

g

ations and commitments 6,044 5,744 30

0

—

—

Total

$6,297 $5,811 $38

0

$ 6

0

$46