Blackberry 2013 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

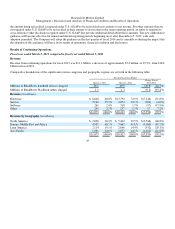

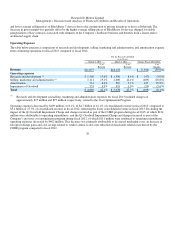

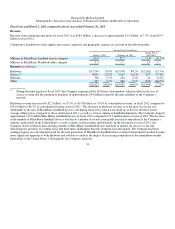

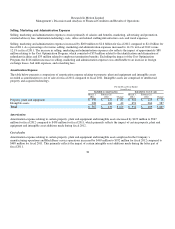

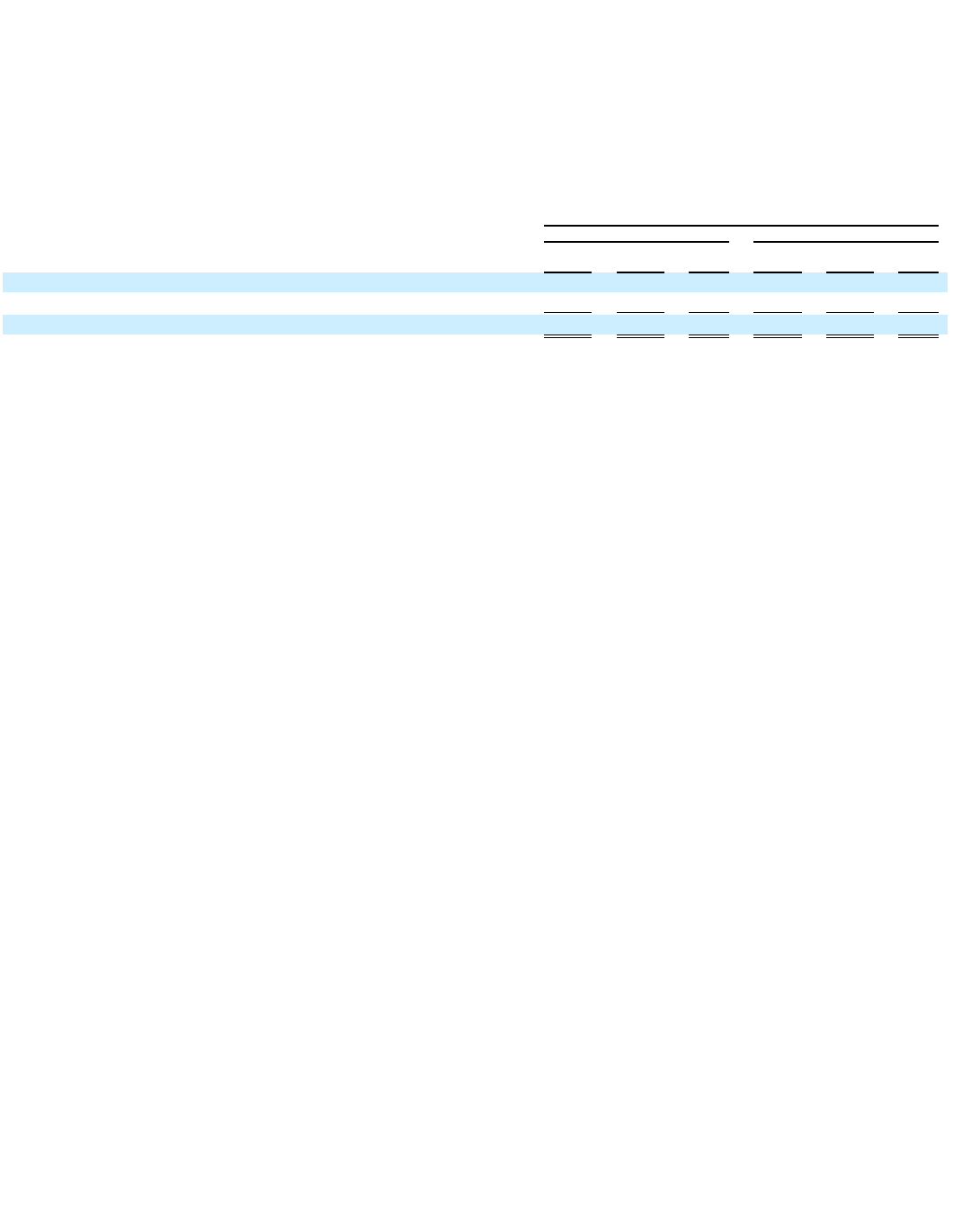

Amortization Expense

The table below presents a comparison of amortization expense relating to property, plant and equipment and intangible assets

recorded as amortization or cost of sales from continuing operations for fiscal 2013 compared to fiscal 2012. Intangible assets are

comprised of patents, licenses and acquired technology.

A

mortization

Amortization expense relating to certain property, plant and equipment and intangible assets increased by $147 million to $714

million for fiscal 2013, compared to $567 million for fiscal 2012, which primarily reflects the impact of certain property, plant and

equipment and intangible asset additions made over the last four quarters.

Cost of sales

Amortization expense relating to certain property, plant and equipment and intangible assets employed in the Company’s

manufacturing operations and BlackBerry service operations increased by $241 million to $1.2 billion for fiscal 2013, compared to

$952 million for fiscal 2012. This increase primarily reflects the impact of renewed or amended licensing agreements and certain

property, plant and equipment asset additions made over the last four quarters.

Impairment of Goodwill

Goodwill represents the excess of an acquisition price over the fair value of identifiable net assets acquired. Goodwill is tested for

impairment annually, through a two step process, in the fourth quarter of each fiscal year, or more frequently if events or changes in

circumstances indicate that goodwill is more likely than not impaired.

The Company performed a goodwill impairment analysis during the fourth quarter of fiscal 2012 and concluded that impairment

existed. Based on the results of that test, the Company recorded the Q4 Goodwill Impairment Charge of $355 million.

Due to business conditions and a continued significant decline in the Company’s market capitalization, the Company concluded that

goodwill impairment indicators existed and an interim goodwill impairment assessment was required for the first quarter of fiscal

2013. The Company used a two-step impairment test to identify potential goodwill impairment and measured the amount of the

goodwill impairment loss to be recognized. In the first step, the fair value of the Company was determined using the Company’s

average

31

For the Fiscal Year Ended

(in millions)

Included in Amortization Included in Cost of sales

March 2,

2013

March 3,

2012 Change

March 2,

2013

March 3,

2012 Change

Property, plant and equipment

$402 $359 $43 $319 $301 $18

Intan

g

ible assets

312 208 104 874

651

223

Total

$714 $567 $147 $1,193 $952 $241