Blackberry 2013 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2013 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research In Motion Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

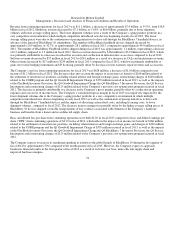

To date, these CORE initiatives have included:

The Company expects to continue to drive cost reductions over the coming fiscal quarters through a continuation of the CORE

program. The Company had initially reported that it expected to incur pre-tax restructuring related charges of approximately $350

million by the end of fiscal 2013; however the Company actually incurred $220 million in pre-tax restructuring costs in fiscal 2013,

primarily associated with the global workforce reduction. Other charges will likely occur as the Company continues to execute on the

CORE program mandate throughout fiscal 2014.

Non-GAAP Financial Measures

As noted above, the Consolidated Financial Statements have been prepared in accordance with U.S. GAAP, and information

contained in this MD&A is presented on that basis. On March 28, 2013, the Company announced financial results for fiscal 2013,

which included certain non-GAAP financial measures, including adjusted net loss from continuing operations and adjusted diluted

loss per share from continuing operations that exclude the impact of pre-tax restructuring charges of $220 million related to the

CORE program, a pre-tax goodwill impairment charge of $335 million and an income tax benefit of $166 million related to the

settlement of uncertain tax positions, including related interest and foreign exchange gains, the Company recorded in fiscal 2013.

Similar non-GAAP financial measures were included in the Company’s presentation of its financial results for the fourth quarter of

fiscal 2013. The term “non-GAAP financial measure” is used to refer to a numerical measure of a company’s historical or future

financial performance, financial position or cash flows that: (i) excludes amounts, or is subject to adjustments that have the effect of

excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with U.S.

GAAP in a company’s statement of income, balance sheet or statement of cash flows; or (ii) includes amounts, or is subject to

adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and

presented. The Company believes that presenting non-GAAP financial measures that exclude the impact of those items enables it and

its shareholders to better assess the Company’s operating performance relative to its consolidated financial results in prior and future

periods and improves the comparability of the information presented. Readers are cautioned that adjusted net loss, adjusted diluted

loss per share and similar measures do not have any standardized meaning prescribed by U.S. GAAP and are therefore unlikely to be

comparable to similarly titled measures reported by other companies. These non-GAAP financial measures should be considered in

the context of the U.S. GAAP results, which are described in this MD&A. A reconciliation of these non-GAAP financial measures to

the most directly comparable U.S. GAAP measures was included in the Company’s press release, dated March 28, 2013.

10

• a global workforce reduction of approximately 5,000 employees. The Company has substantially completed all of its

p

lanned headcount reductions as of March 28, 2013;

• a reduction in the number of layers of management to reduce complexity and drive better clarity, efficiency and

accountabilit

y

across the or

g

anization;

• the continued streamlining of the Company’s supply chain, which include moving from four manufacturing providers to

two and reducin

g

manufacturin

g

sites from ten to four;

• outsourcin

g

the Com

p

an

y

’s

g

lobal re

p

air services and re-en

g

ineerin

g

the Com

p

an

y

’s s

p

are

p

arts

p

rocesses;

• a focus on reducin

g

the Com

p

an

y

’s

p

roduct costs from su

pp

liers;

• targeted use of resources in the Company’s sales and marketing initiatives to more effectively leverage marketing windows

and

p

rioritize marketin

g

efforts and s

p

end in re

g

ions that offer the hi

g

hest o

pp

ortunit

y

and return; and

• further outsourcin

g

of non-core functions as determined durin

g

the im

p

lementation of the CORE

p

ro

g

ram.