Avon 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

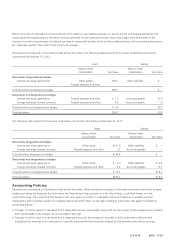

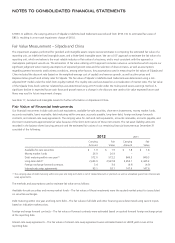

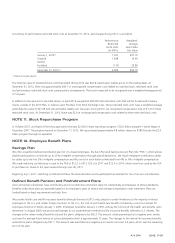

benefit payments for non-qualified retirement plans (see Note 12, Employee Benefit Plans). The foreign exchange forward contracts and

interest-rate swap agreements are hedges of either recorded assets or liabilities or anticipated transactions. The underlying hedged assets and

liabilities or anticipated transactions are not reflected in the table above (see Note 8, Financial Instruments and Risk Management).

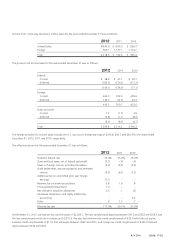

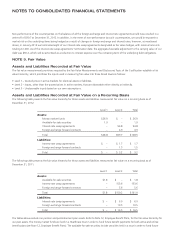

Assets and Liabilities Recorded at Fair Value on a Non-recurring Basis

December 31, 2012 – Silpada

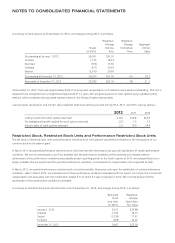

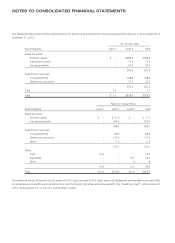

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a non-recurring basis as of

December 31, 2012, and indicates the placement in the fair value hierarchy of the valuation techniques utilized to determine such fair value:

Level 1 Level 2 Level 3 Total

Assets:

Silpada goodwill $ – $ – $ 44.6 $ 44.6

Silpada indefinite-lived trademark – – 40.0 40.0

Silpada finite-lived customer relationships – – 40.0 40.0

Total $ – $ – $124.6 $124.6

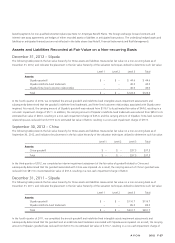

In the fourth quarter of 2012, we completed the annual goodwill and indefinite-lived intangible assets impairment assessments and

subsequently determined that the goodwill, indefinite-lived trademark, and finite-lived customer relationships associated with Silpada were

impaired. As a result, the carrying amount of Silpada’s goodwill was reduced from $116.7 to its estimated fair value of $44.6, resulting in a

non-cash impairment charge of $72.1. In addition, the carrying amount of Silpada’s indefinite-lived trademark was reduced from $85.0 to its

estimated fair value of $40.0, resulting in a non-cash impairment charge of $45.0, and the carrying amount of Silpada’s finite-lived customer

relationships was reduced from $131.9 to its estimated fair value of $40.0, resulting in a non-cash impairment charge of $91.9.

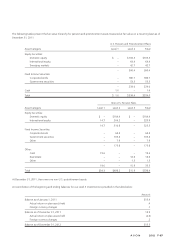

September 30, 2012 – China

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a non-recurring basis as of

September 30, 2012, and indicates the placement in the fair value hierarchy of the valuation techniques utilized to determine such fair value:

Level 1 Level 2 Level 3 Total

Assets:

China goodwill $ – $ – $37.3 $37.3

Total $ – $ – $37.3 $37.3

In the third quarter of 2012, we completed an interim impairment assessment of the fair value of goodwill related to China and

subsequently determined that the goodwill associated with China was impaired. As a result, the carrying amount of China’s goodwill was

reduced from $81.3 to its estimated fair value of $37.3, resulting in a non-cash impairment charge of $44.0.

December 31, 2011 – Silpada

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a non-recurring basis as of

December 31, 2011, and indicates the placement in the fair value hierarchy of the valuation techniques utilized to determine such fair value:

Level 1 Level 2 Level 3 Total

Assets:

Silpada goodwill $ – $ – $116.7 $116.7

Silpada indefinite-lived trademark – – 85.0 85.0

Total $ – $ – $201.7 $201.7

In the fourth quarter of 2011, we completed the annual goodwill and indefinite-lived intangible assets impairment assessments and

subsequently determined that the goodwill and an indefinite-lived trademark associated with Silpada were impaired. As a result, the carrying

amount of Silpada’s goodwill was reduced from $314.7 to its estimated fair value of $116.7, resulting in a non-cash impairment charge of

A V O N 2012 F-27