Avon 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Notes”). The transaction was accounted for as an exchange of debt instruments and, accordingly, the premium related to the original notes

is being amortized over the life of the new 4.625% Notes. The carrying value of the 4.625% Notes represents the $125.0 principal amount,

net of the unamortized discount to face value of $1.0 and $3.7 at December 31, 2012 and 2011, respectively.

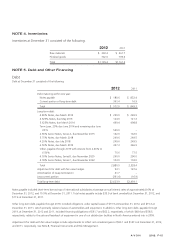

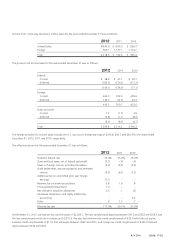

Maturities of Long-Term Debt

Annual maturities of long-term debt (including unamortized discounts and premiums and excluding the adjustments for debt with fair value

hedges) outstanding at December 31, 2012, are as follows:

2013 2014 2015 2016 2017

After

2018 Total

Maturities $389.6 $651.6 $566.2 $5.9 $6.2 $1,266.1 $2,885.6

Other Financing

Revolving Credit Facility

We maintain a $1 billion revolving credit facility (the “revolving credit facility”), which expires in November 2013. As discussed below, the

$1 billion available under the revolving credit facility is effectively reduced by the principal amount of any commercial paper outstanding.

Borrowings under the revolving credit facility bear interest, at our option, at a rate per annum equal to the floating base rate or LIBOR, plus

an applicable margin which varies within a specified band based upon our credit ratings. The revolving credit facility has an annual fee of

$2.0, payable quarterly, based on our current credit ratings. The revolving credit facility may be used for general corporate purposes. As of

December 31, 2012 and 2011, there were no amounts outstanding under the revolving credit facility.

The revolving credit facility contains covenants limiting our ability to, among other things, incur liens and enter into mergers and

consolidations or sales of substantially all our assets, and a financial covenant which requires our interest coverage ratio at the end of each

fiscal quarter to equal or exceed 4:1. In addition, the revolving credit facility contains customary events of default and cross-default

provisions. The interest coverage ratio is determined by dividing our consolidated pre-tax income by our consolidated interest expense, in

each case for the period of four fiscal quarters ending on the date of determination. On July 31, 2012, we obtained a waiver from the

lenders under our revolving credit facility that allowed us to exclude the non-cash impairment charge associated with the Silpada business

recorded during the fourth quarter of 2011 from the interest coverage ratio calculation pursuant to our revolving credit facility for the four

fiscal quarters ended September 30, 2012. On December 21, 2012, we entered into an amendment to the revolving credit facility, primarily

relating to the calculation of components of the interest coverage ratio that allows us, subject to certain conditions and limitations, to add

back to our consolidated net income: (i) extraordinary and other non-cash losses and expenses, (ii) one-time fees, cash charges and other

cash expenses, premiums or penalties incurred in connection with any asset sale, equity issuance or incurrence or repayment of debt or

refinancing or amendment of any debt instrument and (iii) cash charges and other cash expenses, premiums or penalties incurred in

connection with any restructuring or relating to any legal or regulatory action, settlement, judgment or ruling, in an aggregate amount not

to exceed $400.0 for the period from October 1, 2012 until the termination of commitments under the revolving credit facility. As of

December 31, 2012, and based on then interest rates, approximately $250 of the $1 billion revolving credit facility, less the principal amount

of commercial paper outstanding (which was zero at December 31, 2012), could have been drawn down without violating any covenant. If

not for the more restrictive interest coverage ratio calculation under our Private Notes (which, pursuant to a notice, is required to be prepaid

on March 29, 2013, see above), we would have been able to draw down on the entire $1 billion under our revolving credit facility at

December 31, 2012 without violating any covenant. The interest coverage ratio, under our revolving credit facility, for the four fiscal quarters

ended December 31, 2012 was 6.64:1 and excludes certain cash and non-cash charges pursuant to the December 2012 amendment.

Commercial Paper Program

We also maintain a $1 billion commercial paper program, which is supported by the revolving credit facility. Under this program, we may

issue from time to time unsecured promissory notes in the commercial paper market in private placements exempt from registration under

federal and state securities laws, for a cumulative face amount not to exceed $1 billion outstanding at any one time and with maturities not

exceeding 270 days from the date of issue. The commercial paper short-term notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. Outstanding commercial paper effectively reduces the amount available for

borrowing under the revolving credit facility. At December 31, 2012, there was no outstanding commercial paper under this program. In

2012, the demand for our commercial paper declined, partially impacted by the rating agency action described below.