Avon 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

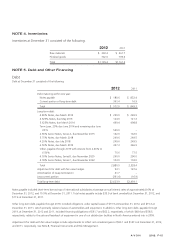

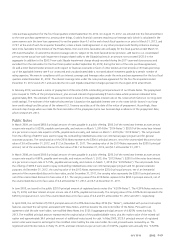

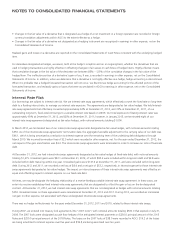

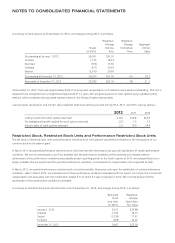

Income from continuing operations, before taxes for the years ended December 31 was as follows:

2012 2011 2010

United States $(436.5) $ (395.1) $ (228.7)

Foreign 655.1 1,137.7 1,174.1

Total $ 218.6 $ 742.6 $ 945.4

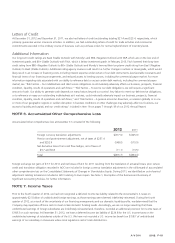

The provision for income taxes for the years ended December 31 was as follows:

2012 2011 2010

Federal:

Current $ 38.8 $ 41.7 $ 40.1

Deferred (183.9) (176.6) (117.2)

(145.1) (134.9) (77.1)

Foreign:

Current 266.0 372.6 409.6

Deferred 144.5 (12.9) 22.4

410.5 359.7 432.0

State and other:

Current 1.2 (1.5) 3.6

Deferred (9.8) (7.1) (8.3)

(8.6) (8.6) (4.7)

Total $ 256.8 $ 216.2 $ 350.2

The foreign provision for income taxes includes the U.S. tax cost on foreign earnings of $156.8, $24.7 and $24.3 for the years ended

December 31, 2012, 2011 and 2010, respectively.

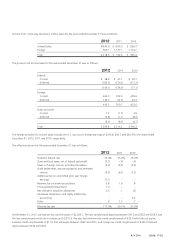

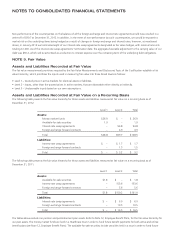

The effective tax rate for the years ended December 31 was as follows:

2012 2011 2010

Statutory federal rate 35.0% 35.0% 35.0%

State and local taxes, net of federal tax benefit (2.5) (.4) (.4)

Taxes on foreign income, including translation (3.9) (4.4) (2.4)

Audit settlements, statute expirations and amended

returns (4.2) (4.3) (2.5)

Additional tax on unremitted prior year foreign

earnings 77.0 – –

Reserves for uncertain tax positions 5.8 1.6 .8

China goodwill impairment 7.0 – –

Net change in valuation allowances 2.9 .1 (.2)

Venezuela devaluation and highly inflationary

accounting – – 6.0

Other .4 1.5 .7

Effective tax rate 117.5% 29.1% 37.0%

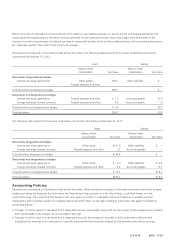

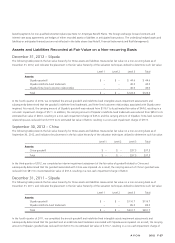

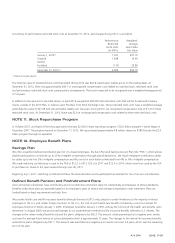

At December 31, 2012, we had tax loss carryforwards of $2,183.7. The loss carryforwards expiring between 2013 and 2032 are $168.3 and

the loss carryforwards which do not expire are $2,015.4. We also had minimum tax credit carryforwards of $35.9 which do not expire,

business credit carryforwards of $11.6 that will expire between 2020 and 2031, and foreign tax credit carryforwards of $356.0 that will

expire between 2018 and 2022.

A V O N 2012 F-21