Avon 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

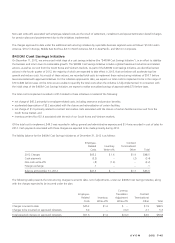

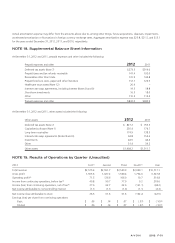

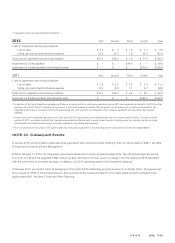

(2) Operating profit was impacted by the following:

2012 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $ 2.7 $ .7 $ (.2) $ 1.3 $ 4.5

Selling, general and administrative expenses 24.6 37.5 1.8 56.3 120.2

Total costs to implement restructuring initiatives $27.3 $38.2 $ 1.6 $ 57.6 $124.7

Impairment of China goodwill $ – $ – $44.0 $ – $ 44.0

Impairment of Silpada goodwill and intangible assets $ – $ – $ – $209.0 $209.0

2011 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $ 1.2 $ 3.5 $ 3.5 $ 3.0 $ 11.2

Selling, general and administrative expenses 13.5 8.5 1.1 5.7 28.8

Total costs to implement restructuring initiatives $14.7 $12.0 $ 4.6 $ 8.7 $ 40.0

Impairment of Silpada goodwill and intangible asset $ – $ – $ – $263.0 $263.0

(3) In addition to the items impacting operating profit above, income (loss) from continuing operations during 2012 was impacted by a benefit of $23.8 to other

expense, net in 2012 due to the release of a provision in the fourth quarter associated with the excess cost of acquiring U.S. dollars in Venezuela at the

regulated market rate as compared to the official exchange rate. This provision was released as the Company capitalized the associated intercompany

liabilities.

(4) Income (loss) from continuing operations, net of tax during 2012 was impacted by an additional provision for income taxes of $168.3. During the fourth

quarter of 2012, we determined that the Company may repatriate offshore cash to meet certain domestic funding needs. Accordingly, we are no longer

asserting that the undistributed earnings of foreign subsidiaries are indefinitely reinvested.

(5) The sum of per share amounts for the quarters does not necessarily equal that for the year because the computations were made independently.

NOTE 20. Subsequent Events

In January 2013, we terminated interest-rate swap agreements with notional amounts totaling $1,000, for net proceeds of $88.1. See Note

8, Financial Instruments and Risk Management.

Effective February 13, 2013, the Venezuelan government devalued its currency by approximately 32%. The official exchange rate moved

from 4.30 to 6.30 and the regulated SITME market has been eliminated. This will result in a charge in the first quarter of 2013 associated

with the write-down of monetary net assets. In addition, our 2013 operating margin will be negatively impacted.

In February 2013, we issued a notice of prepayment of the entire $535 outstanding principal amount of our Private Notes. The prepayment

price is equal to 100% of the principal amount, plus accrued interest of approximately $7 and a make-whole premium estimated to be

approximately $65. See Note 5, Debt and Other Financing.

A V O N 2012 F-53