Avon 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

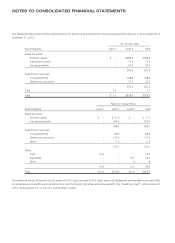

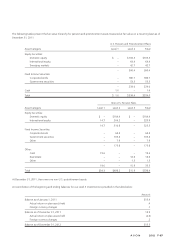

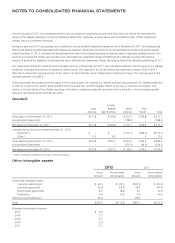

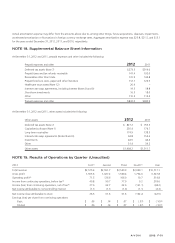

The charges, net of adjustments, of initiatives under the $400M Cost Savings Initiative by reportable business segment were as follows:

Latin

America

Europe,

Middle East

& Africa

North

America

Asia

Pacific Corporate Total

Charges incurred to date $12.9 $1.1 $18.0 $12.9 $3.6 $48.5

Charges to be incurred on approved initiatives 8.6 1.0 (2.4) (2.1) .2 5.3

Total expected charges on approved initiatives $21.5 $2.1 $15.6 $10.8 $3.8 $53.8

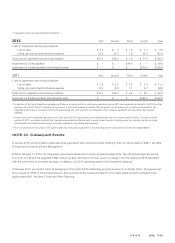

As noted previously, for the initiatives approved to date, we expect to record total costs to implement in the range of $70 to $80 before taxes

under the $400M Cost Savings Initiative. The amounts shown in the tables above as charges recorded to date relate to initiatives that have been

approved and recorded in the financial statements as the costs are probable and estimable. The amounts shown in the tables above as total

expected charges on approved initiatives represent charges recorded to date plus charges yet to be recorded for approved initiatives as the relevant

accounting criteria for recording an expense have not yet been met. In addition to the charges included in the tables above, we have incurred and

will incur other costs to implement restructuring initiatives such as other professional services and accelerated depreciation.

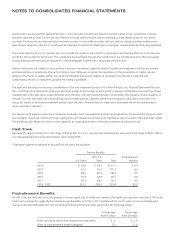

NOTE 16. Contingencies

FCPA Investigations

As previously reported, we have engaged outside counsel to conduct an internal investigation and compliance reviews focused on

compliance with the Foreign Corrupt Practices Act (“FCPA”) and related U.S. and foreign laws in China and additional countries. The

internal investigation, which is being conducted under the oversight of our Audit Committee, began in June 2008.

As previously reported in July 2009, in connection with the internal investigation, we commenced compliance reviews regarding the FCPA

and related U.S. and foreign laws in additional countries in order to evaluate our compliance efforts. We are conducting these compliance

reviews in a number of countries selected to represent each of the Company’s international geographic segments. The internal investigation

and compliance reviews are focused on reviewing certain expenses and books and records processes, including, but not limited to, travel,

entertainment, gifts, use of third-party vendors and consultants and related due diligence, joint ventures and acquisitions, and payments to

third-party agents and others, in connection with our business dealings, directly or indirectly, with foreign governments and their employees.

The internal investigation and compliance reviews of these matters are ongoing. In connection with the internal investigation and

compliance reviews, certain personnel actions, including termination of employment of certain senior members of management, have been

taken, and additional personnel actions may be taken in the future. In connection with the internal investigation and compliance reviews,

we continue to enhance our ethics and compliance program, including our policies and procedures, FCPA compliance-related training, FCPA

third-party due diligence program and other compliance-related resources.

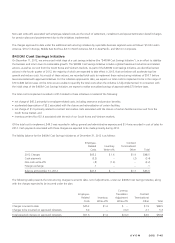

As previously reported in October 2008, we voluntarily contacted the United States Securities and Exchange Commission (“SEC”) and the

United States Department of Justice (“DOJ”) to advise both agencies of our internal investigation. We have cooperated and continue to

cooperate with investigations of these matters by the SEC and the DOJ. We have, among other things, signed tolling agreements, responded

to inquiries, translated and produced documents, assisted with interviews, and provided information on our internal investigation and

compliance reviews, personnel actions taken and steps taken to enhance our ethics and compliance program. As previously reported in

August 2012, we are in discussions with the SEC and the DOJ regarding resolving the government investigations. These discussions are

ongoing. There can be no assurance that a settlement with the SEC and the DOJ will be reached or, if a settlement is reached, the timing of

any such settlement or the terms of any such settlement. We expect any such settlement may include civil and/or criminal fines and penalties

as well as non-monetary remedies, such as oversight requirements and additional remediation and compliance requirements. We may be

required to incur significant future costs to comply with the non-monetary terms of any settlement with the SEC and the DOJ. Under certain

circumstances, we may also be required to advance significant professional fees and expenses to certain current and former Company

employees in connection with these matters. Until any settlement or other resolution of these matters, we expect to continue to incur costs,

primarily professional fees and expenses, which may be significant, in connection with the government investigations.

At this point we are unable to predict the developments in, outcome of, and economic and other consequences of the government

investigations or their impact on our earnings, cash flow, liquidity, financial condition and ongoing business. However, based on our most

recent communications with the DOJ and the SEC, the Company believes that it is probable that the Company will incur a loss related to the

government investigations. We are unable to reasonably estimate the amount or range of such loss; however such loss could be material.