Avon 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

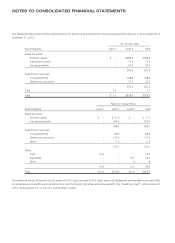

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

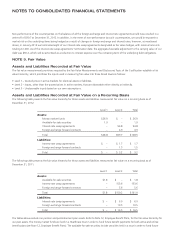

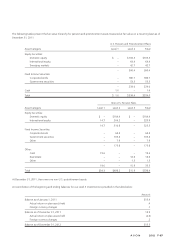

The following tables present the fair value hierarchy for pension and postretirement assets measured at fair value on a recurring basis as of

December 31, 2012:

U.S. Pension Plans

Asset Category Level 1 Level 2 Total

Equity Securities:

Domestic equity $ – $186.4 $186.4

International equity – 71.0 71.0

Emerging markets – 50.5 50.5

– 307.9 307.9

Fixed Income Securities:

Corporate bonds – 148.0 148.0

Government securities – 72.2 72.2

– 220.2 220.2

Cash 1.1 – 1.1

Total $ 1.1 $528.1 $529.2

Non-U.S. Pension Plans

Asset Category Level 1 Level 2 Level 3 Total

Equity Securities:

Domestic equity $ – $ 71.3 $ – $ 71.3

International equity – 297.4 – 297.4

– 368.7 – 368.7

Fixed Income Securities:

Corporate bonds – 85.9 – 85.9

Government securities – 113.3 – 113.3

Other – 11.5 – 11.5

– 210.7 – 210.7

Other:

Cash 16.4 – – 16.4

Real estate – – 13.1 13.1

Other – – .4 .4

16.4 – 13.5 29.9

Total $16.4 $579.4 $13.5 $609.3

As mentioned above, during the second quarter of 2012 approximately $40 of assets previously designated and intended to be used solely

for postretirement benefits were transferred to a trust that funds both active and retiree benefits (the “healthcare trust”). At December 31,

2012, there were no U.S. or non-U.S. postretirement assets.