Avon 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

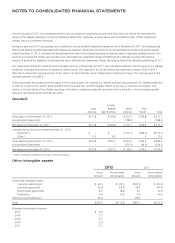

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

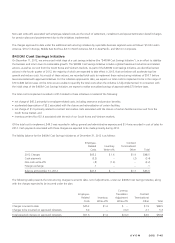

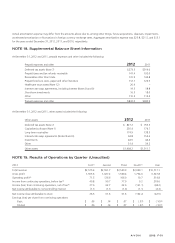

2011 First Second Third Fourth(1) Year

Total revenue $2,629.1 $2,856.4 $2,762.4 $3,043.7 $11,291.6

Gross profit 1,679.3 1,838.4 1,764.1 1,861.2 7,143.0

Operating profit(2) 246.5 316.6 278.6 12.9 854.6

Income (loss) from continuing operations, before tax 224.9 293.7 241.3 (17.3) 742.6

Income from continuing operations, net of tax 152.2 208.7 165.2 .3 526.4

Discontinued operations, net of tax (8.6) – – – (8.6)

Net income attributable to noncontrolling interest – (2.5) (1.0) (.7) (4.2)

Net income (loss) attributable to Avon 143.6 206.2 164.2 (.4) 513.6

Earnings per share from continuing operations

Basic $ .35 $ .48 $ .38 $ – $ 1.20(5)

Diluted $ .35 $ .47 $ .38 $ – $ 1.20(5)

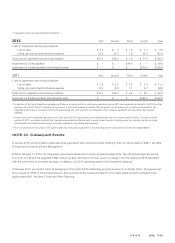

(1) As discussed in Note 1, Description of the Business and Summary of Significant Accounting Policies, we recorded out-of-period adjustments in 2012 and 2011

that related to prior periods.

2012

During the first quarter of 2012, we recorded an out-of-period adjustment which decreased earnings by approximately $14 before tax ($10 after tax) which

related to 2011 and was associated with bad debt expense in our South Africa operations.

During the second quarter of 2012, we recorded an out-of-period adjustment which increased earnings by approximately $5 before tax ($3 after tax) which

related to prior years and was associated with vendor liabilities in North America. During the second quarter of 2012, we recorded an out-of-period

adjustment which decreased earnings by approximately $4 before tax ($4 after tax) which related to prior years and was associated with brochure costs in

Poland.

In addition to the adjustments previously mentioned, in 2012, we also recorded out-of-period adjustments in the aggregate of approximately $1 before tax

($5 after tax) that related to prior years.

2011

During the first quarter of 2011, we recorded out-of-period adjustments associated with Discontinued operations, net of tax for prior periods resulting in a

charge of approximately $9, which would have decreased Discontinued operations, net of tax during the fourth quarter of 2010 by approximately $13 and

increased a prior period by approximately $4.

During the fourth quarter of 2011, we recorded adjustments of approximately $25 before tax ($17 after tax) of which approximately $14 before tax ($10

after tax) related to prior quarters of 2011 and was primarily associated with inventory in our Brazil operations. The remaining fourth quarter out-of-period

adjustments of approximately $11 before tax ($7 after tax) related to prior years.

During the other quarters of 2011, we also recorded out-of-period adjustments in the aggregate of approximately $10 before tax ($7 after tax) that related to

prior years.

We evaluated the out-of-period adjustments in 2012 and 2011, both individually and in the aggregate, in relation to the quarterly and annual periods in

which they originated and the annual period in which they were corrected, and concluded that these adjustments were not material to the consolidated

annual financial statements for all impacted periods.