Avon 2012 Annual Report Download - page 54

Download and view the complete annual report

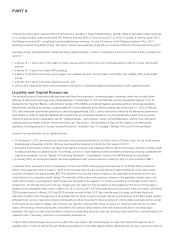

Please find page 54 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2014 and thereafter, (ii) amend the interest coverage ratio to, subject to the most favored lender provision, add back to our consolidated

pre-tax income actual non-cash impairment charges related solely to the Silpada business in an amount not to exceed $125 in the aggregate

(in addition to the $263 non-cash Silpada impairment charge already recorded during the 2011 year-end close process and excluded from

the calculation for the four fiscal quarters ended September 30, 2012) during the term of the note purchase agreement, (iii) add a most

favored lender provision with respect to financial covenants in favor of other lenders and (iv) provide a 150 basis point step up of the

applicable interest rate if our unsecured and unsubordinated debt is not rated above investment grade by a certain number of rating

agencies. We were in compliance with our interest coverage and leverage ratios under the note purchase agreement for the four fiscal

quarters ended December 31, 2012. The interest coverage ratio under the note purchase agreement for the four fiscal quarters ended

December 31, 2012 was 4.25:1 and excludes the non-cash Silpada impairment charges pursuant to the August 2012 amendment.

In February 2013, we issued a notice of prepayment of the entire $535 outstanding principal amount of our Private Notes. The prepayment

price is equal to 100% of the principal amount, plus accrued interest of approximately $7 and a make-whole premium estimated to be

approximately $65. The estimate of the accrued interest is based on the applicable interest rate on the notes (which factors in our long-term

credit ratings). The estimate of the make-whole premium is based on the applicable interest rate on the notes (which factors in our long-

term credit ratings) and the prices of the relevant U.S. Treasury securities as of the date of the notice of prepayment. Accordingly, these

amounts may change when we make the final calculation of the prepayment price two business days in advance of the prepayment date,

which is March 29, 2013.

Public Notes

In March 2009, we issued, in a public offering, $500 principal amount of 5.625% Notes, due March 1, 2014 and $350 principal amount of

6.50% Notes, due March 1, 2019. In March 2008, we issued, in a public offering, $250 principal amount of 4.80% Notes, due March 1,

2013 and $250 principal amount of 5.75% Notes, due March 1, 2018. The proceeds from these offerings were used to repay the

outstanding indebtedness under our commercial paper program and for general corporate purposes. We also have outstanding $250

principal amount of 4.20% Notes, due July 15, 2018 and $125 principal amount of 4.625% Notes, due May 15, 2013.

Commercial Paper Program

We also maintain a $1 billion commercial paper program, which is supported by the revolving credit facility. Under this program, we may

issue from time to time unsecured promissory notes in the commercial paper market in private placements exempt from registration under

federal and state securities laws, for a cumulative face amount not to exceed $1 billion outstanding at any one time and with maturities not

exceeding 270 days from the date of issue. The commercial paper short-term notes issued under the program are not redeemable prior to

maturity and are not subject to voluntary prepayment. Outstanding commercial paper effectively reduces the amount available for

borrowing under the revolving credit facility. At December 31, 2012, there was no outstanding commercial paper under this program. In

2012, the demand for our commercial paper declined, partially impacted by the rating agency action described below.

Additional Information

Our long-term credit ratings are Baa2 (Stable Outlook) with Moody’s and BBB- (Negative Outlook) with S&P, which are on the low end of

investment grade, and BB+ (Stable Outlook) with Fitch, which is below investment grade. In February 2013, Fitch lowered their long-term

credit rating from BBB- (Negative Outlook) to BB+ (Stable Outlook) and Moody’s lowered their long-term credit rating from Baa1 (Negative

Outlook) to Baa2 (Stable Outlook). Additional rating agency reviews could result in a further change in outlook or downgrade, which would

likely result in an increase in financing costs, including interest expense under certain of our debt instruments, less favorable covenants and

financial terms of our financing arrangements, and reduced access to lending sources, including the commercial paper market. For more

information regarding risks associated with our ability to refinance debt or access certain debt markets, including the commercial paper

market, see “Risk Factors – Our indebtedness and debt service obligations could materially adversely affect our business, prospects, financial

condition, liquidity, results of operations and cash flows,” “Risk Factors – To service our debt obligations, we will require a significant

amount of cash. Our ability to generate cash depends on many factors beyond our control. Any failure to meet our debt service obligations,

or to refinance or repay our outstanding indebtedness as it matures, could materially adversely impact our business, prospects, financial

condition, liquidity, results of operations and cash flows,” and “Risk Factors – A general economic downturn, a recession globally or in one

or more of our geographic regions or sudden disruption in business conditions or other challenges may adversely affect our business, our

access to liquidity and capital, and our credit ratings” included in Item 1A on pages 7 through 18 of our 2012 Annual Report.

Please also refer to Note 5, Debt and Other Financing, on pages F-15 through F-19 of our 2012 Annual Report for more details relating to

our debt and the maturities thereof.

A V O N 2012 47