Avon 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

the third quarter of 2011, we considered whether any circumstances existed that would more likely than not reduce the estimated fair

values of the Silpada reporting unit and its trademark below their respective carrying values and concluded another interim impairment

analysis was not considered necessary.

During our year-end 2011 close process, we completed our annual goodwill impairment assessment as of November 30, 2011 and subsequently

determined that the goodwill associated with Silpada was impaired. Specifically, the results of our annual impairment testing during the quarter

ended December 31, 2011, indicated that the estimated fair value of our Silpada reporting unit was less than its respective carrying amount. As a

result of our impairment testing, we recorded a non-cash before tax impairment charge of $198.0 ($125.1 after tax) to reduce the carrying

amount of goodwill for Silpada to its estimated fair value. Following the impairment charge, the carrying value of the Silpada goodwill was $116.7.

Our impairment testing for indefinite-lived intangible assets as of November 30, 2011, also indicated a decline in the fair value of our Silpada

trademark intangible asset below its respective carrying value. This resulted in a non-cash before tax impairment charge of $65.0 ($41.1

after tax) to reduce the carrying amount of this asset to its estimated fair value. Following the impairment charge, the carrying value of the

Silpada trademark was $85.0.

Following weaker than expected performance in the fourth quarter, we lowered our revenue and earnings projections for Silpada largely due

to the rise in silver prices, which nearly doubled since the acquisition, and the negative impact of pricing on revenues and margins. The

decline in the fair values of the Silpada reporting unit and the underlying trademark was driven by the reduction in the forecasted growth

rates and cash flows used to estimate fair value.

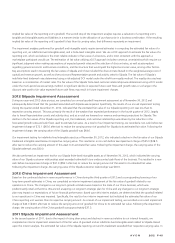

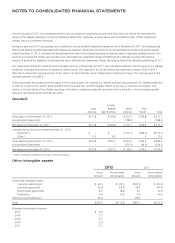

Goodwill

Latin

America

Europe,

Middle

East & Africa

North

America

Asia

Pacific Total

Gross balance at December 31, 2011 $111.8 $160.8 $ 314.7 $ 83.8 $ 671.1

Accumulated impairments – – (198.0) – (198.0)

Net balance at December 31, 2011 $111.8 $160.8 $ 116.7 $ 83.8 $ 473.1

Changes during the period ended December 31, 2012:

Impairment $ – $ – $ (72.1) $(44.0) $(116.1)

Other(1) 11.0 6.5 – .4 17.9

Gross balance at December 31, 2012 $122.8 $167.3 $ 314.7 $ 84.2 $ 689.0

Accumulated impairments – – (270.1) (44.0) (314.1)

Net balance at December 31, 2012 $122.8 $167.3 $ 44.6 $ 40.2 $ 374.9

(1) Other is primarily comprised of foreign currency translation.

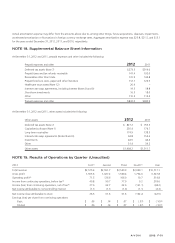

Other intangible assets

2012 2011

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Finite-Lived Intangible Assets

Customer relationships $ 93.5 $ (47.1) $221.8 $ (65.2)

Licensing agreements 62.8 (53.6) 58.2 (47.4)

Noncompete agreements 8.6 (8.6) 8.1 (6.6)

Trademarks 6.6 (6.3) 6.6 (4.0)

Indefinite-Lived Trademarks 64.4 – 108.4 –

Total $235.9 $(115.6) $403.1 $(123.2)

Estimated Amortization Expense:

2013 $ 8.5

2014 7.3

2015 6.7

2016 5.9

2017 5.5