Avon 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

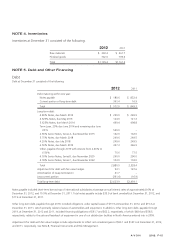

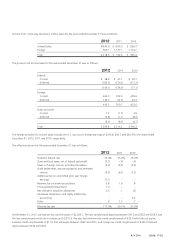

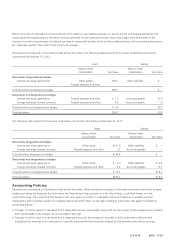

NOTE 4. Inventories

Inventories at December 31 consisted of the following:

2012 2011

Raw materials $ 393.4 $ 361.7

Finished goods 742.0 799.6

Total $1,135.4 $1,161.3

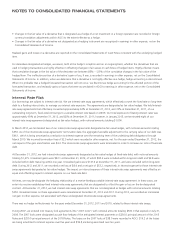

NOTE 5. Debt and Other Financing

Debt

Debt at December 31 consisted of the following:

2012 2011

Debt maturing within one year:

Notes payable $ 180.6 $ 832.4

Current portion of long-term debt 391.4 16.9

Total $ 572.0 $ 849.3

Long-term debt:

4.80% Notes, due March 2013 $ 250.0 $ 249.9

4.625% Notes, due May 2013 124.0 121.3

5.625% Notes, due March 2014 499.4 498.8

Term Loan, 25% due June 2014 and remaining due June

2015 550.0 –

2.60% Senior Notes, Series A, due November 2015 142.0 142.0

5.75% Notes, due March 2018 249.6 249.5

4.20% Notes, due July 2018 249.6 249.5

6.50% Notes, due March 2019 347.3 346.9

Other, payable through 2019 with interest from 2.40% to

6.50% 75.6 77.5

4.03% Senior Notes, Series B, due November 2020 290.0 290.0

4.18% Senior Notes, Series C, due November 2022 103.0 103.0

Total 2,880.5 2,328.4

Adjustments for debt with fair value hedges 93.1 147.6

Amortization of swap termination 41.7 –

Less current portion (391.4) (16.9)

Total long-term debt $2,623.9 $2,459.1

Notes payable included short-term borrowings of international subsidiaries at average annual interest rates of approximately 8.6% at

December 31, 2012, and 10.5% at December 31, 2011. Total notes payable include $35.9 of bank overdrafts at December 31, 2012, and

$17.4 at December 31, 2011.

Other long-term debt, payable through 2019, included obligations under capital leases of $13.9 at December 31, 2012, and $15.3 at

December 31, 2011, which primarily relate to leases of automobiles and equipment. In addition, other long-term debt, payable through

2019, at December 31, 2012 and 2011, included financing obligations of $61.7 and $62.2, respectively, of which $48.4 and $58.5,

respectively, relates to the sale and leaseback of equipment in one of our distribution facilities in North America entered into in 2009.

Adjustments for debt with fair value hedges include adjustments to reflect net unrealized gains of $93.1 and $147.6 at December 31, 2012,

and 2011, respectively. See Note 8, Financial Instruments and Risk Management.

A V O N 2012 F-15