Avon 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

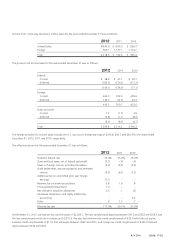

We did not include stock options to purchase 22.0 million shares for the year ended December 31, 2012, 22.9 million shares for 2011, and

18.5 million shares for 2010 of Avon common stock in the calculations of diluted EPS because the exercise prices of those options were

greater than the average market price and their inclusion would be anti-dilutive. We also did not include stock options to purchase .6 million

shares for the year ended December 31, 2012, as we had a net loss attributable to Avon and the inclusion of these shares would decrease

the net loss per share. Since this would be anti-dilutive, such shares are excluded from the calculation.

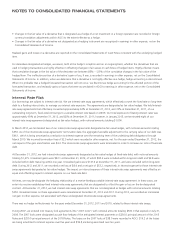

NOTE 2. New Accounting Standards

Standards Implemented

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2011-04, Fair Value

Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS.

ASU 2011-04 provides a consistent definition of fair value and ensures that the fair value measurement and disclosure requirements are

similar between U.S. GAAP and International Financial Reporting Standards. ASU 2011-04 changes certain fair value measurement principles

and enhances the disclosure requirements particularly for level 3 fair value measurements. ASU 2011-04 is effective for Avon as of January 1,

2012 and did not have a significant impact on our financial statements.

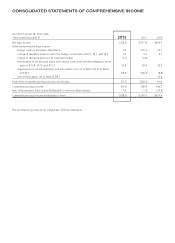

In June 2011, the FASB issued ASU 2011-05, Presentation of Comprehensive Income. ASU 2011-05 requires entities to present items of net

income and other comprehensive income either in one continuous statement, referred to as the statement of comprehensive income, or in

two separate, but consecutive, statements of net income and other comprehensive income. In addition, in December 2011, the FASB issued

ASU 2011-12, Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other

Comprehensive Income in Accounting Standards Update No. 2011-05. ASU 2011-12 defers the requirement to present components of

reclassifications of comprehensive income on the statement of comprehensive income, with all other requirements of ASU 2011-05

unaffected. Both ASU 2011-05 and 2011-12 are effective as of January 1, 2012 for Avon and did not have a significant impact on our

financial statements, other than presentation.

In September 2011, the FASB issued ASU 2011-08, Testing Goodwill for Impairment. ASU 2011-08 provides entities with an option to

perform a qualitative assessment to determine whether further impairment testing is necessary. ASU 2011-08 is effective for annual and

interim goodwill impairment tests for Avon as of January 1, 2012 and did not have a significant impact on our financial statements.

In July 2012, the FASB issued ASU 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment. ASU 2012-02 provides entities with an

option to perform a qualitative assessment to determine whether further impairment testing is necessary. We elected to early adopt ASU

2012-02 in the fourth quarter of 2012 and this did not have a significant impact on our financial statements.

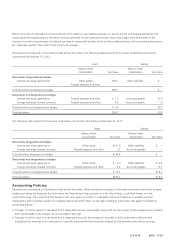

NOTE 3. Discontinued Operations

On November 8, 2010, the Company announced that Avon International Operations, Inc. (“AIO”), a wholly-owned subsidiary of the

Company, had agreed to sell the ownership interest in Avon Products Company Limited (“Avon Japan”) held by AIO pursuant to a tender

offer bid agreement between AIO and Devon Holdings K.K., an affiliate of TPG Capital (“Buyer”). The transaction included both the sale of

the Company’s stake in Avon Japan as well as certain pre-paid royalties in connection with intellectual property licenses for an aggregate

cash consideration of approximately $90. Avon Japan was previously reported within our Asia Pacific segment.

The transaction closed on December 29, 2010. Of the total cash consideration received, $81 was recognized in December 2010, resulting in

a net after-tax gain of $10. The remaining $9 of the consideration received related to the use of Avon’s global brands, formulas and

products, and the use of the Avon name in Japan for a five-year period. This portion of the royalty will be recognized on a straight line basis

over five years within continuing operations.

During 2011, we determined that the net after-tax gain on sale of Avon Japan should have been reported as a net after-tax loss of $3, to

correctly include all balances relating to Avon Japan that were previously included in Accumulated Other Comprehensive Loss (“AOCI”). See

Note 1, Description of the Business and Summary of Significant Accounting Policies, for further information.