Avon 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

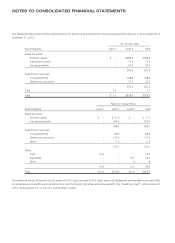

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Non-performance of the counterparties on the balance of all the foreign exchange and interest rate agreements would have resulted in a

write-off of $99.7 at December 31, 2012. In addition, in the event of non-performance by such counterparties, we would be exposed to

market risk on the underlying items being hedged as a result of changes in foreign exchange and interest rates; however, as mentioned

above, in January 2013 we terminated eight of our interest-rate swap agreements designated as fair value hedges, with notional amounts

totaling $1,000. As of the interest-rate swap agreements’ termination date, the aggregate favorable adjustment to the carrying value of our

debt was $90.4, which will be amortized as a reduction to interest expense over the remaining term of the underlying debt obligations.

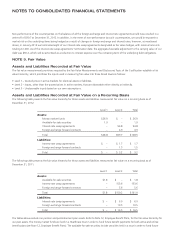

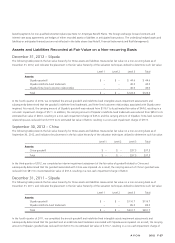

NOTE 9. Fair Value

Assets and Liabilities Recorded at Fair Value

The fair value measurement provisions required by the Fair Value Measurements and Disclosures Topic of the Codification establish a fair

value hierarchy, which prioritizes the inputs used in measuring fair value into three broad levels as follows:

• Level 1 – Quoted prices in active markets for identical assets or liabilities.

• Level 2 – Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly.

• Level 3 – Unobservable inputs based on our own assumptions.

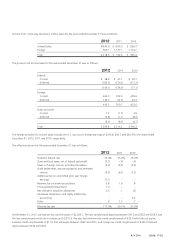

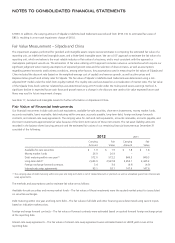

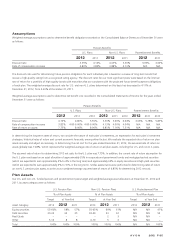

Assets and Liabilities Recorded at Fair Value on a Recurring Basis

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a recurring basis as of

December 31, 2012:

Level 1 Level 2 Total

Assets:

Money market funds $26.9 $ – $ 26.9

Available-for-sale securities 1.9 – 1.9

Interest-rate swap agreements – 94.8 94.8

Foreign exchange forward contracts – 4.9 4.9

Total $28.8 $99.7 $128.5

Liabilities:

Interest-rate swap agreements $ – $ 1.7 $ 1.7

Foreign exchange forward contracts – 1.5 1.5

Total $ – $ 3.2 $ 3.2

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a recurring basis as of

December 31, 2011:

Level 1 Level 2 Total

Assets:

Available-for-sale securities $1.8 $ – $ 1.8

Interest-rate swap agreements – 153.6 153.6

Foreign exchange forward contracts – 5.6 5.6

Total $1.8 $159.2 $161.0

Liabilities:

Interest-rate swap agreements $ – $ 6.0 $ 6.0

Foreign exchange forward contracts – 10.5 10.5

Total $ – $ 16.5 $ 16.5

The tables above exclude our pension and postretirement plan assets. Refer to Note 12, Employee Benefit Plans, for the fair value hierarchy for

our plan assets. The money market funds are held in a Healthcare trust in order to fund future benefit payments for both active and retiree

benefit plans (see Note 12, Employee Benefit Plans). The available-for-sale securities include securities held in a trust in order to fund future