Avon 2012 Annual Report Download - page 82

Download and view the complete annual report

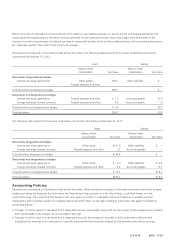

Please find page 82 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.note purchase agreement for the four fiscal quarters ended September 30, 2012. On August 15, 2012, we entered into the first amendment

to the note purchase agreement to, among other things, (i) add a financial covenant requiring our leverage ratio (which is calculated in the

same manner as in the term loan agreement) to not be greater than 4:1 at the end of each fiscal quarter on or prior to March 31, 2013, and

3.75:1 at the end of each fiscal quarter thereafter, unless a bank credit agreement or any other principal credit facility contains a leverage

ratio more favorable to the holders of the Private Notes, then such more favorable ratio will apply for the fiscal quarters ended March 31,

2014 and thereafter, (ii) amend the interest coverage ratio to, subject to the most favored lender provision, add back to our consolidated

pre-tax income actual non-cash impairment charges related solely to the Silpada business in an amount not to exceed $125.0 in the

aggregate (in addition to the $263.0 non-cash Silpada impairment charge already recorded during the 2011 year-end close process and

excluded from the calculation for the four fiscal quarters ended September 30, 2012) during the term of the note purchase agreement,

(iii) add a most favored lender provision with respect to financial covenants in favor of other lenders and (iv) provide a 150 basis point step

up of the applicable interest rate if our unsecured and unsubordinated debt is not rated above investment grade by a certain number of

rating agencies. We were in compliance with our interest coverage and leverage ratios under the note purchase agreement for the four fiscal

quarters ended December 31, 2012. The interest coverage ratio under the note purchase agreement for the four fiscal quarters ended

December 31, 2012 was 4.25:1 and excludes the non-cash Silpada impairment charges pursuant to the August 2012 amendment.

In February 2013, we issued a notice of prepayment of the entire $535 outstanding principal amount of our Private Notes. The prepayment

price is equal to 100% of the principal amount, plus accrued interest of approximately $7 and a make-whole premium estimated to be

approximately $65. The estimate of the accrued interest is based on the applicable interest rate on the notes (which factors in our long-term

credit ratings). The estimate of the make-whole premium is based on the applicable interest rate on the notes (which factors in our long-

term credit ratings) and the prices of the relevant U.S. Treasury securities as of the date of the notice of prepayment. Accordingly, these

amounts may change when we make the final calculation of the prepayment price two business days in advance of the prepayment date,

which is March 29, 2013.

Public Notes

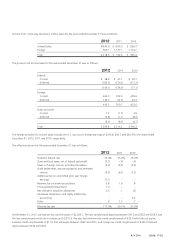

In March 2009, we issued $850.0 principal amount of notes payable in a public offering. $500.0 of the notes bear interest at a per annum

coupon rate equal to 5.625%, payable semi-annually, and mature on March 1, 2014 (the “2014 Notes”). $350.0 of the notes bear interest

at a per annum coupon rate equal to 6.50%, payable semi-annually, and mature on March 1, 2019 (the “2019 Notes”). The net proceeds

from the offering of $837.6 were used to repay the outstanding indebtedness under our commercial paper program and for general

corporate purposes. The carrying value of the 2014 Notes represents the $500.0 principal amount, net of the unamortized discount to face

value of $.6 at December 31, 2012, and $1.2 at December 31, 2011. The carrying value of the 2019 Notes represents the $350.0 principal

amount, net of the unamortized discount to face value of $2.7 at December 31, 2012, and $3.1 at December 31, 2011.

In March 2008, we issued $500.0 principal amount of notes payable in a public offering. $250.0 of the notes bear interest at a per annum

coupon rate equal to 4.80%, payable semi-annually, and mature on March 1, 2013, (the “2013 Notes”). $250.0 of the notes bear interest

at a per annum coupon rate of 5.75%, payable semi-annually, and mature on March 1, 2018 (the “2018 Notes”). The net proceeds from

the offering of $496.3 were used to repay outstanding indebtedness under our commercial paper program and for general corporate

purposes. At December 31, 2012, the carrying value of the 2013 Notes represents the $250.0 principal amount, net of an immaterial

amount of the unamortized discount to face value, and at December 31, 2011, the carrying value represents the $250.0 principal amount,

net of the unamortized discount to face value of $.1. The carrying value of the 2018 Notes represents the $250.0 principal amount, net of

the unamortized discount to face value of $.4 at December 31, 2012, and $.5 at December 31, 2011.

In June 2003, we issued to the public $250.0 principal amount of registered senior notes (the “4.20% Notes”). The 4.20% Notes mature on

July 15, 2018, and bear interest at a per annum rate of 4.20%, payable semi-annually. The carrying value of the 4.20% Notes represents the

$250.0 principal amount, net of the unamortized discount to face value of $.4 and $.5 at December 31, 2012 and 2011, respectively.

In April 2003, the call holder of $100.0 principal amount of 6.25% Notes due May 2018 (the “Notes”), embedded with put and call option

features, exercised the call option associated with these Notes, and thus became the sole note holder of the Notes. Pursuant to an

agreement with the sole note holder, we modified these Notes into $125.0 aggregate principal amount of 4.625% notes due May 15,

2013. The modified principal amount represented the original value of the putable/callable notes, plus the market value of the related call

option and approximately $4.0 principal amount of additional notes issued for cash. In May 2003, $125.0 principal amount of registered

senior notes were issued in exchange for the modified notes held by the sole note holder. No cash proceeds were received by us. The

registered senior Notes mature on May 15, 2013, and bear interest at a per annum rate of 4.625%, payable semi-annually (the “4.625%

A V O N 2012 F-17