Avon 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

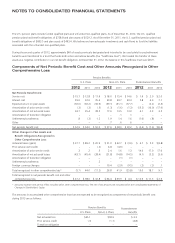

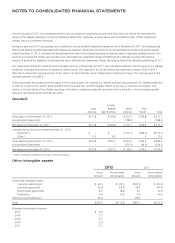

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 14. Leases and Commitments

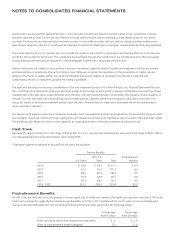

Minimum rental commitments under noncancellable operating leases, primarily for equipment and office facilities at December 31, 2012,

are included in the following table under leases. Purchase obligations include commitments to purchase paper, inventory and other services.

Year Leases

Purchase

Obligations

2013 $114.9 $ 423.4

2014 94.0 264.5

2015 75.8 171.8

2016 64.7 104.8

2017 41.7 105.4

Later years 148.5 2.2

Sublease rental income (18.2) –

Total $521.4 $1,072.1

Rent expense was $133.3 in 2012, $138.8 in 2011, and $126.1 in 2010. Plant construction, expansion and modernization projects with an

estimated cost to complete of approximately $110.6 were in progress at December 31, 2012.

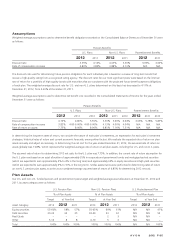

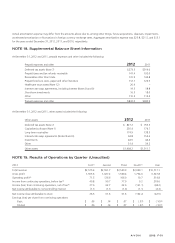

NOTE 15. Restructuring Initiatives

2005 and 2009 Restructuring Programs

We launched restructuring programs in late 2005 (the “2005 Restructuring Program”) and in February 2009 (the “2009 Restructuring

Program”). The 2005 and 2009 Restructuring Programs initiatives include:

• enhancement of organizational effectiveness, including efforts to flatten the organization and bring senior management closer to

consumers through a substantial organizational downsizing;

• implementation of a global manufacturing strategy through facilities realignment;

• implementation of additional supply chain efficiencies in distribution;

• restructuring our global supply chain operations;

• realigning certain local business support functions to a more regional base to drive increased efficiencies; and

• streamlining of transactional and other services through outsourcing, moves to lower-cost countries, and reorganizing certain other

functions.

We have approved and announced all of the initiatives that are part of our 2005 and 2009 Restructuring Programs. We believe that we have

substantially realized the anticipated savings associated with our 2005 Restructuring Program, and we are on track to achieve our

anticipated savings associated with our 2009 Restructuring Program. The savings achieved from these Restructuring Programs have been

offset by investments in Representative Value Proposition and advertising. Since 2005, we have recorded total costs to implement

restructuring initiatives of $527.1 before taxes for actions associated with the 2005 Restructuring Program, but we expect our total costs

when fully implemented to be approximately $525 before taxes when considering historical and future costs along with expected gains from

sales of properties. With regards to the 2009 Restructuring Program, we have recorded total costs to implement restructuring initiatives of

$255.0 before taxes and expect total costs to implement to reach approximately $260 before taxes. We have incurred and will incur other

costs to implement restructuring initiatives for other professional services and accelerated depreciation. The future costs are expected to be

partially offset by expected gains on the sales of properties exited due to restructuring initiatives.

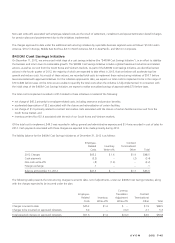

Restructuring Charges – 2010

During 2010, we recorded total costs to implement of $80.7 associated with previously approved initiatives that are part of our 2005 and

2009 Restructuring Programs, and the costs consisted of the following:

• net charge of $41.3 primarily for employee-related costs, including severance and pension benefits;

• implementation costs of $27.7 for professional service fees, primarily associated with our initiatives to outsource certain finance processes,

realign certain distribution operations, realign certain support functions to a more regional basis and realign certain manufacturing facilities;and

• accelerated depreciation of $11.7 associated with our initiatives to realign certain distribution operations and close certain manufacturing

operations.