Avon 2012 Annual Report Download - page 75

Download and view the complete annual report

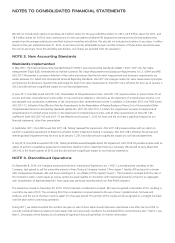

Please find page 75 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

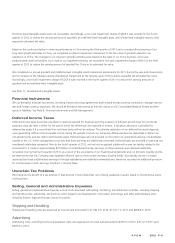

carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of

an asset exceeds its estimated future cash flows, an impairment charge is recognized for the amount by which the carrying amount of the

asset exceeds the fair value of the asset.

We capitalize interest on borrowings during the active construction period of major capital projects. Capitalized interest is added to the cost

of the related asset and depreciated over the useful life of the related asset. We capitalized interest of $2.0 for 2012, $.4 for 2011, and $5.3

for 2010.

Capitalized Software

Certain systems development costs related to the purchase, development and installation of computer software are capitalized and

amortized over the estimated useful life of the related project, generally not to exceed five years. Costs incurred prior to the development

stage, as well as maintenance, training costs, and general and administrative expenses are expensed as incurred. Other assets included

unamortized capitalized software costs of $235.4 at December 31, 2012 and $176.7 at December 31, 2011.

Goodwill and Intangible Assets

Goodwill is not amortized and is assessed for impairment annually during the fourth quarter or on the occurrence of an event that indicates

impairment may have occurred, at the reporting unit level. A reporting unit is the operating segment, or a component, which is one level

below that operating segment. Components are aggregated as a single reporting unit if they have similar economic characteristics. When

testing goodwill for impairment, we perform either a qualitative or quantitative assessment for each of our reporting units. Factors

considered in the qualitative analysis include macroeconomic conditions, industry and market considerations, cost factors and overall

financial performance specific to the reporting unit. If the qualitative analysis results in a more likely than not probability of impairment, the

first quantitative step, as described below, is required.

The quantitative test to evaluate goodwill for impairment is a two-step process. In the first step, we compare the fair value of a reporting

unit to its carrying value. If the fair value of a reporting unit is less than its carrying value, we perform a second step to determine the implied

fair value of the reporting unit’s goodwill. The second step of the impairment analysis requires a valuation of a reporting unit’s tangible and

intangible assets and liabilities in a manner similar to the allocation of the purchase price in a business combination. If the resulting implied

fair value of the reporting unit’s goodwill is less than its carrying value, that difference represents an impairment. The impairment analysis

performed for goodwill requires several estimates in computing the estimated fair value of a reporting unit. We use a discounted cash flow

(“DCF”) approach to estimate the fair value of a reporting unit, which we believe is the most reliable indicator of fair value of this business,

and is most consistent with the approach a marketplace participant would use.

Indefinite-lived intangible assets are not amortized, but rather are assessed for impairment annually during the fourth quarter or on the

occurrence of an event that indicates impairment may have occurred. When testing indefinite-lived intangible assets for impairment, we

perform either a qualitative or quantitative assessment. If the qualitative analysis results in a more likely than not probability of impairment, a

quantitative assessment is required. The quantitative test to evaluate indefinite-lived intangible assets for impairment compares the fair value

of the intangible asset to its carrying value. If the fair value of the asset is less than its carrying value, that difference represents an

impairment. The impairment analysis performed for indefinite-lived intangible asset requires several estimates in computing the estimated

fair value of the asset. We use a risk-adjusted DCF model under the relief-from-royalty method.

Finite-lived intangible assets are amortized using a straight-line method over the estimated useful lives of the assets. Intangible assets are

reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be fully recoverable. If

such a change in circumstances occurs, the related estimated future undiscounted cash flows expected to result from the use of the asset

and its eventual disposition are compared to the carrying amount. If the sum of the expected cash flows is less than the carrying amount, an

impairment charge is recorded. The impairment charge is measured as the amount by which the carrying amount exceeds the fair value of

the asset. The fair value of the asset is determined using probability weighted expected cash flow estimates, quoted market prices when

available and appraisals, as appropriate.

If applicable, the impairment testing should be performed in the following order: indefinite-lived intangible assets, finite-lived intangible

assets, and then goodwill.

We completed our annual goodwill and indefinite-lived intangible assets impairment assessments for 2012 during the year-end close process

and our analysis of the Silpada business indicated an impairment as the carrying value of the business exceeded the estimated fair value and