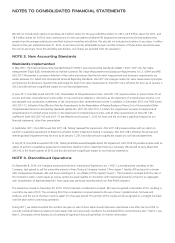

Avon 2012 Annual Report Download - page 76

Download and view the complete annual report

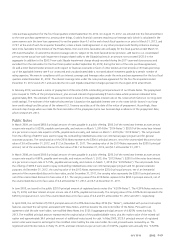

Please find page 76 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the finite-lived intangible assets were not recoverable. Accordingly, a non-cash impairment charge of $209.0 was recorded in the fourth

quarter of 2012 to reduce the carrying amounts of goodwill, an indefinite-lived intangible asset, and a finite-lived intangible asset to their

respective estimated fair value.

Based on the continued decline in revenue performance in China during the third quarter of 2012 and a corresponding lowering of our

long-term growth estimates in China, we completed an interim impairment assessment of the fair value of goodwill related to our

operations in China. The changes to our long-term growth estimates were based on the state of our China business, which was

predominantly retail at that time. As a result of our impairment testing, we recorded a non-cash impairment charge of $44.0 in the third

quarter of 2012 to reduce the carrying amount of goodwill for China to its estimated fair value.

We completed our annual goodwill and indefinite-lived intangible assets impairment assessments for 2011 during the year-end close process

and our analysis of the Silpada business indicated an impairment as the carrying value of the business exceeded the estimated fair value.

Accordingly, a non-cash impairment charge of $263.0 was recorded in the fourth quarter of 2011 to reduce the carrying amounts of

goodwill and an indefinite-lived intangible asset.

See Note 17, Goodwill and Intangible Assets.

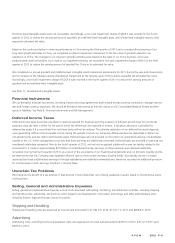

Financial Instruments

We use derivative financial instruments, including interest-rate swap agreements and forward foreign currency contracts to manage interest

rate and foreign currency exposures. We record all derivative instruments at their fair values on the Consolidated Balance Sheets as either

assets or liabilities. See Note 8, Financial Instruments and Risk Management.

Deferred Income Taxes

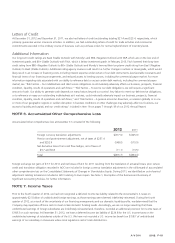

Deferred income taxes have been provided on items recognized for financial reporting purposes in different periods than for income tax

purposes using tax rates in effect for the year in which the differences are expected to reverse. A valuation allowance is provided for

deferred tax assets if it is more likely than not these items will not be realized. The ultimate realization of our deferred tax assets depends

upon generating sufficient future taxable income during the periods in which our temporary differences become deductible or before our

net operating loss and tax credit carryforwards expire. Deferred taxes are not provided on the portion of unremitted earnings of subsidiaries

outside of the U.S. when management concludes that these earnings are indefinitely reinvested. Deferred taxes are provided on earnings not

considered indefinitely reinvested. Prior to the fourth quarter of 2012, we had not recognized a deferred income tax liability related to the

incremental U.S. taxes on approximately $2.5 billion of undistributed foreign earnings, as these earnings were deemed indefinitely

reinvested. During the fourth quarter of 2012, as a result of the uncertainty of our financing arrangements and our domestic liquidity profile,

we determined that the Company may repatriate offshore cash to meet certain domestic funding needs. Accordingly, we are no longer

asserting that these undistributed earnings of foreign subsidiaries are indefinitely reinvested and, therefore, recorded an additional provision

for income taxes on such earnings. See Note 7, Income Taxes.

Uncertain Tax Positions

We recognize the benefit of a tax position, if that position is more likely than not of being sustained on audit, based on the technical merits

of the position.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include costs associated with selling; marketing; and distribution activities, including shipping

and handling costs; advertising; net brochure costs; research and development; information technology; and other administrative costs,

including finance, legal and human resource functions.

Shipping and Handling

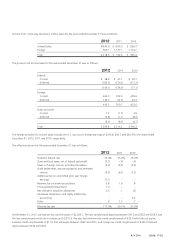

Shipping and handling costs are expensed as incurred and amounted to $1,030.3 in 2012, $1,071.7 in 2011 and $968.8 in 2010.

Advertising

Advertising costs, excluding brochure preparation costs, are expensed as incurred and amounted to $253.6 in 2012, $311.2 in 2011 and

$400.4 in 2010.

A V O N 2012 F-11