Avon 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

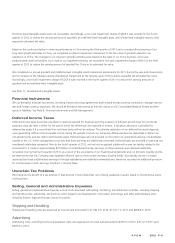

CONSOLIDATED STATEMENTS OF CHANGES

IN SHAREHOLDERS’ EQUITY

Common Stock Additional

Paid-In

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Treasury Stock Non-

controlling

Interest(In millions, except per share data) Shares Amount Shares Amount Total

Balances at December 31, 2009 740.9 $186.1 $1,941.0 $4,383.9 $(692.6) 313.4 $(4,545.8) $40.0 $1,312.6

Comprehensive income:

Net income 606.3 3.0 609.3

Foreign currency translation adjustments 55.4 4.2 59.6

Amortization of net actuarial losses, prior service

credit, and transition obligation, net of taxes

of $12.2 25.5 25.5

Adjustments of net actuarial losses and prior

service cost, net of taxes of $5.1 (8.8) (8.8)

Sale of Avon Japan, net of taxes of $8.1 10.6 10.6

Net derivative losses on cash flow hedges, net

of taxes of $2.2 4.1 4.1

Total comprehensive income 700.3

Dividends – $.88 per share (379.4) (379.4)

Exercise / vesting and expense of share-based

compensation 2.4 .5 78.9 – .6 80.0

Repurchase of common stock .4 (14.1) (14.1)

Purchases and sales of noncontrolling interests,

net of dividends paid of $3.8 (31.1) (31.1)

Income tax benefits – stock transactions 4.3 4.3

Balances at December 31, 2010 743.3 $186.6 $2,024.2 $4,610.8 $(605.8) 313.8 $(4,559.3) $16.1 $1,672.6

Comprehensive income:

Net income 513.6 4.2 517.8

Foreign currency translation adjustments (175.7) (.4) (176.1)

Amortization of net actuarial losses, prior service

credit, and transition obligation, net of taxes

of $14.5 29.4 29.4

Adjustments of net actuarial losses and prior

service cost, net of taxes of $46.9 (103.4) (103.4)

Net derivative losses on cash flow hedges, net

of taxes of $2.1 3.9 3.9

Net derivative gains on net investment hedge (2.8) (2.8)

Total comprehensive income 268.8

Dividends – $.92 per share (398.3) (398.3)

Exercise / vesting and expense of share-based

compensation 1.6 .7 53.7 – .7 55.1

Repurchase of common stock .3 (7.7) (7.7)

Purchases and sales of noncontrolling interests,

net of dividends paid of $5.1 (5.1) (5.1)

Income tax benefits – stock transactions (.2) (.2)

Balances at December 31, 2011 744.9 $187.3 $2,077.7 $4,726.1 $(854.4) 314.1 $(4,566.3) $14.8 $1,585.2

Comprehensive loss:

Net (loss) income (42.5) 4.3 (38.2)

Foreign currency translation adjustments (.2) .6 .4

Amortization of net actuarial losses, prior service

credit, and transition obligation, net of taxes

of $15.8 33.9 33.9

Adjustments of net actuarial losses and prior

service cost, net of taxes of $17.8 (58.4) (58.4)

Net derivative losses on cash flow hedges, net

of taxes of $2.1 3.9 3.9

Net derivative gains on net investment hedge (1.5) (1.5)

Total comprehensive loss (59.9)

Dividends – $.75 per share (325.8) (325.8)

Exercise / vesting and expense of share-based

compensation 1.8 1.0 44.3 (.1) 3.2 48.5

Repurchase of common stock .5 (8.8) (8.8)

Purchases and sales of noncontrolling interests,

net of dividends paid of $3.5 (3.5) (3.5)

Income tax benefits – stock transactions (2.4) (2.4)

Balances at December 31, 2012 746.7 $188.3 $2,119.6 $4,357.8 $(876.7) 314.5 $(4,571.9) $16.2 $1,233.3

The accompanying notes are an integral part of these statements.

A V O N 2012 F-7