Avon 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Letters of Credit

At December 31, 2012 and December 31, 2011, we also had letters of credit outstanding totaling $21.4 and $23.4, respectively, which

primarily guarantee various insurance activities. In addition, we had outstanding letters of credit for trade activities and commercial

commitments executed in the ordinary course of business, such as purchase orders for normal replenishment of inventory levels.

Additional Information

Our long-term credit ratings are Baa2 (Stable Outlook) with Moody’s and BBB- (Negative Outlook) with S&P, which are on the low end of

investment grade, and BB+ (Stable Outlook) with Fitch, which is below investment grade. In February 2013, Fitch lowered their long-term

credit rating from BBB- (Negative Outlook) to BB+ (Stable Outlook) and Moody’s lowered their long-term credit rating from Baa1 (Negative

Outlook) to Baa2 (Stable Outlook). Additional rating agency reviews could result in a further change in outlook or downgrade, which would

likely result in an increase in financing costs, including interest expense under certain of our debt instruments, less favorable covenants and

financial terms of our financing arrangements, and reduced access to lending sources, including the commercial paper market. For more

information regarding risks associated with our ability to refinance debt or access certain debt markets, including the commercial paper

market, see “Risk Factors – Our indebtedness and debt service obligations could materially adversely affect our business, prospects, financial

condition, liquidity, results of operations and cash flows,” “Risk Factors – To service our debt obligations, we will require a significant

amount of cash. Our ability to generate cash depends on many factors beyond our control. Any failure to meet our debt service obligations,

or to refinance or repay our outstanding indebtedness as it matures, could materially adversely impact our business, prospects, financial

condition, liquidity, results of operations and cash flows,” and “Risk Factors – A general economic downturn, a recession globally or in one

or more of our geographic regions or sudden disruption in business conditions or other challenges may adversely affect our business, our

access to liquidity and capital, and our credit ratings” included in Item 1A on pages 7 through 18 of our 2012 Annual Report.

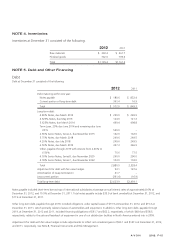

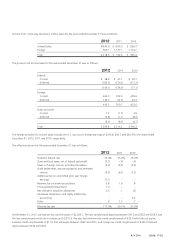

NOTE 6. Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss at December 31 consisted of the following:

2012 2011

Foreign currency translation adjustments $(317.6) $(325.0)

Pension and postretirement adjustment, net of taxes of $257.4

and $252.9 (548.0) (515.9)

Net derivative losses from cash flow hedges, net of taxes of

$3.7 and $5.8 (11.1) (13.5)

Total $(876.7) $(854.4)

Foreign exchange net gains of $7.7 for 2012 and net losses of $2.0 for 2011 resulting from the translation of actuarial losses, prior service

credit and translation obligation recorded in AOCI are included in foreign currency translation adjustments in the rollforward of accumulated

other comprehensive loss on the Consolidated Statements of Changes in Shareholders Equity. During 2011, we identified an out-of-period

adjustment relating to balances included in AOCI relating to Avon Japan. See Note 1, Description of the Business and Summary of

Significant Accounting Policies, for further information.

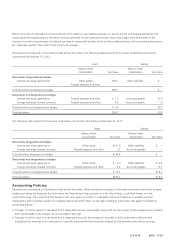

NOTE 7. Income Taxes

Prior to the fourth quarter of 2012, we had not recognized a deferred income tax liability related to the incremental U.S. taxes on

approximately $2.5 billion of undistributed foreign earnings, as these earnings were deemed indefinitely reinvested. During the fourth

quarter of 2012, as a result of the uncertainty of our financing arrangements and our domestic liquidity profile, we determined that the

Company may repatriate offshore cash to meet certain domestic funding needs. Accordingly, we are no longer asserting that these

undistributed earnings of foreign subsidiaries are indefinitely reinvested and, therefore, recorded an additional provision for income taxes of

$168.3 on such earnings. At December 31, 2012, we have a deferred income tax liability of $224.8 for the U.S. income taxes on the

undistributed earnings of subsidiaries outside of the U.S. We have not recorded a U.S. income tax benefit on $158.7 of undistributed

earnings of our subsidiary in Venezuela where local regulations restrict cash distributions.

A V O N 2012 F-19